EURUSD Price Analysis – May 28

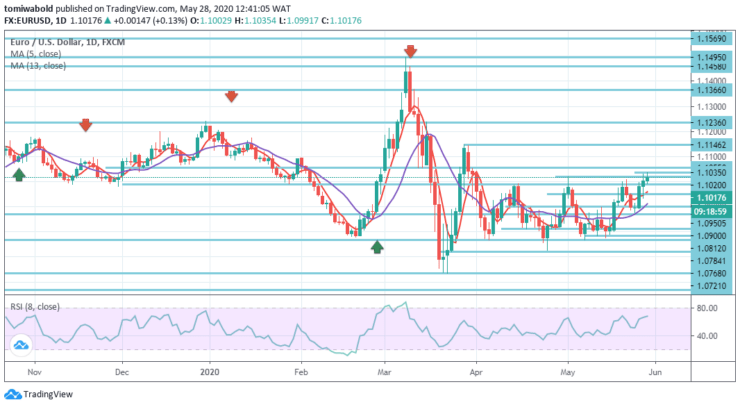

EURUSD appears supported but tries to maintain traction beyond the 1.1000 regions as sellers keep threatening recovery and prices recede to sub-1.10.tFollowing the improved mood in the risk-associated system, the FX pair finally surpassed the 1.10 barrier in the previous and present session, especially after the European Commission ( EC) announced a €750 billion bailout plan to support the economic recovery.

Key Levels

Resistance Levels: 1.1495, 1.1146, 1.1035

Support Levels: 1.0950, 1.0870, 1.0768

Eventually, EURUSD has succeeded in securing the 1.1000 resistance although it still tries to maintain the rally around it. Additionally, USD-dynamics tend to push uncertainty all over the pair. As the topside resistance is breached, the bias May, therefore, be much farther upside, mainly once it can retain north of level 1.1020.

The pair is currently gaining 0.03 percent at level 1.1006 and faces initial contest at level 1.0990 (low) closely followed by level 1.0950 (low) and subsequently level 1.0900 (low). On the upside, a breach beyond the 1.1055 (high) level may aim for a 1.1146 (high) level on the way to 1.1236 level (61.8 percent retracement).

EURUSD holds a drastic shift on the four-hour chart and the relative strength index is beyond 60, except for the overbought zone. The currency pair has exceeded a downtrend that has followed it since the beginning of May and is now positioned within an uptrend.

Resistance lies ahead of the near-term high of 1.1035 at the eight-week level. This is accompanied by a level of 1.1146 that was a significant swing in March. Support lies at level 1.0990, a launching point on the upward path. It is followed by level 1.0950 from last week, a swing high. On the downward, breach of 1.0870 minor support level may shift bias to the negative side for 1.0812 support level initially.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.