EURUSD Price Analysis – December 21

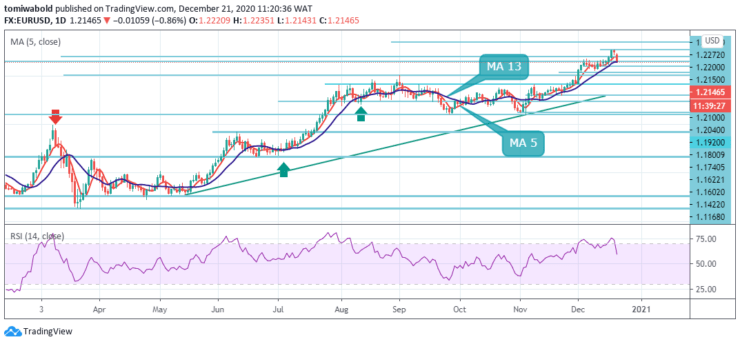

EURUSD fell below the 1.22 level and some subsequent selling could accelerate the corrective fall towards 1.2100. The resumption of the decline in major currencies may be associated with a rebound in the rally in the US dollar against its major counterparts. The US dollar index opened the week with a bullish gap of about 20 points.

Key Levels

Resistance Levels: 1.2350, 1.2272, 1.2200

Support Levels: 1.2150, 1.2100, 1.2040

The technical trend on the daily chart implies that any subsequent decline is likely to find decent support and attract buyers near the 1.2150 horizontal support and 13 moving average. Some subsequent sell-offs may accelerate the corrective slide towards 1.2100, although more likely to stay limited around 1.2040.

However, a sustained breach beneath would be seen as early signs of bullish exhaustion and leave the pair vulnerable to further declines to challenge the key psychological 1.2000 marks. We are watching closely for the top signs near the 1.2300 level. But a sustained breakout may have long-term bullish consequences.

EURUSD intraday bias altered neutral after today’s pullback. Some sideways trading is possible, but further gains may be anticipated as long as the support level of 1.2050 is held. On the other hand, a breach of the 1.2272 level may restart a stronger rebound to 61.8% of the 1.0635 forecasts to 1.2011 levels from 1.1602 at the next 1.2350 levels.

On the other hand, European session highs around 1.2272 now seem to act as immediate resistance. It is followed by last week’s swing high, around 1.2270 areas, which, if cleared decisively, may set the stage for further short-term appreciation. The pair may then breach beyond 1.2300 and aim to test the next major obstacle near the 1.2350 congestion zone.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.