EURUSD Price Analysis – November 30

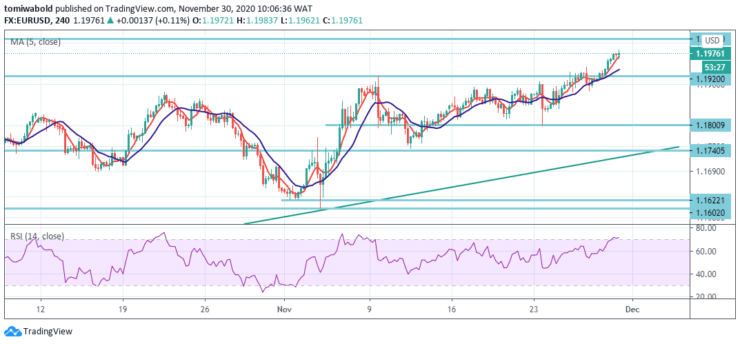

The EURUSD has continued its recent upside swing with an attempt to run through the 1.20 marks suggesting price is en route to its 2020 2-year high at 1.2011 level after days of range. The US dollar has also been on the back foot as news coming from the vaccine front encouraged investors to take profits on US stocks.

Key Levels

Resistance Levels: 1.2150, 1.2050, 1.2011

Support Levels: 1.1900, 1.1800, 1.1740

EURUSD continues trading above the daily moving average of 5 and 13 but the Relative Strength Index is confronting the 70 indexes pointing to overbought conditions. This development also adds to the case of a downward correction.

Above the round number of 1.20 level, the critical level to watch is the 2020 peak of 1.2011. Meanwhile, the next initial resistance awaits at the 1.2050 level. Above that hurdle, the world’s most popular currency pair is back to levels last seen in 2018, with 1.2095 level as the next target.

The intraday bias in EURUSD stays on the upside for retesting the 1.2011 high level. The sustained breach of the 1.2011 high level may restart the total rebound from the 1.0635 low level. Further, the next goal is the 61.8% forecast of 1.0635 to 1.2011 levels from 1.1612 at 1.2165 levels.

On the downside, however, breach of the 1.1800 support level may alter intraday bias to the downside, to extend the ranging trend from the 1.2011 level with another falling phase. All in, only a break of 1.1900 initial downside round number would indicate that the risk for further EUR strength has dissipated.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.