EURUSD Price Analysis – November 26

EURUSD continues to gain traction for the 3rd day in a row and comfortably breaks past the 1.1920 marks. The pair registered a positive move and gained some follow-through traction on Thursday amid persistent selling pressure surrounding the US dollar.

Key Levels

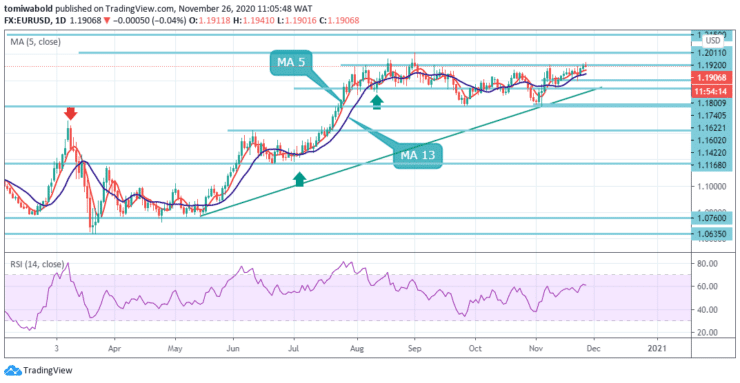

Resistance Levels: 1.2150, 1.2011, 1.1920

Support Levels: 1.1800, 1.1740, 1.1622

From a technical point of view on the daily chart, the breakout of the high resistance of the prior monthly fluctuation around 1.1920 may have already paved the way for a return to the key 1.2011 level. On the other hand, the 5 moving average at 1.1880 now appears to be protecting the immediate downturn.

In a broader context, the increase from 1.0635 is seen as the third trend cycle from the 1.0339 (low) level. Further, a sustained rally to the cluster resistance at 1.2150 can be seen. This scenario may remain preferable as long as the resistance at 1.1422, which turned into a support level, remains unaltered.

In the short term, EURUSD’s failure to hold above the 1.1920 level could lead to a pullback to the 4-hour moving average 13, which is currently at 1.1890. Adoption above 1.1920 is likely to generate stronger buying pressure. Meanwhile, EURUSD intraday bias remains positive for retest at 1.2011 high.

However, a decisive break could resume the general rally from the 1.0635 low. On the other hand, a break of near-term support at 1.1800 could displace the trend down to continue the consolidation trend from 1.2011 with another cycle of decline.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.