EURUSD Price Analysis – November 5

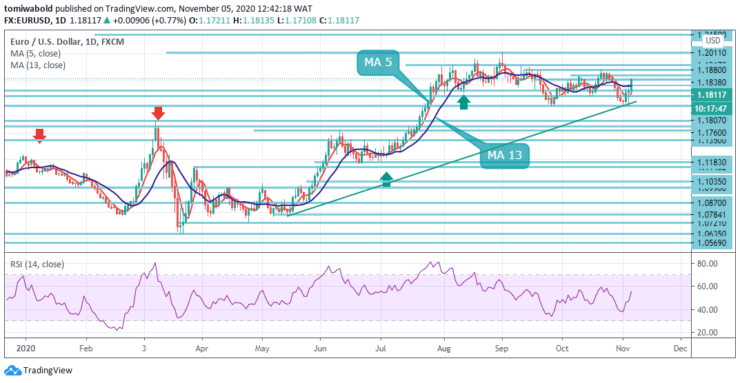

The buying bias remains on the EURUSD as it spikes for yet another session lifting the pair to a new weekly high past the 1.1800 level. Amid optimism on the markets, buyers cheer the prospects of a decisive result in the US elections.

Key levels

Resistance Levels: 1.2011, 1.1917, 1.1808

Support Levels: 1.1760, 1.1612, 1.1495

As seen in the daily chart, given the lack of RSI oversold conditions, coupled with the pair’s failure to break through key upside barriers at 1.1838, sellers are likely to regain control, targeting 1.1760 as immediate support.

More broadly, the rise from 1.0635 is seen as the third cycle of the trend from 1.0339 (low). Hence, a further rally towards the cluster resistance at 1.2011 is anticipated. This may stay the preferred option as long as the 1.1422 resistance turned into support is held.

EURUSD intraday bias altered bullish with the current rebound. Another decline may stay moderately favorable with the 1.1880 resistance level remaining. The breakdown of the 1.1612 level will restart the corrective decline from the 1.2011 level.

The next goal is a 38.2% recovery from 1.0635 to 1.2011 at 1.1495 levels. On the other hand, the breakout of the 1.1880 level will be the first sign that the correction from the 1.2011 level has ended. The intraday bias once again will try to climb to 1.1880 for validation.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.