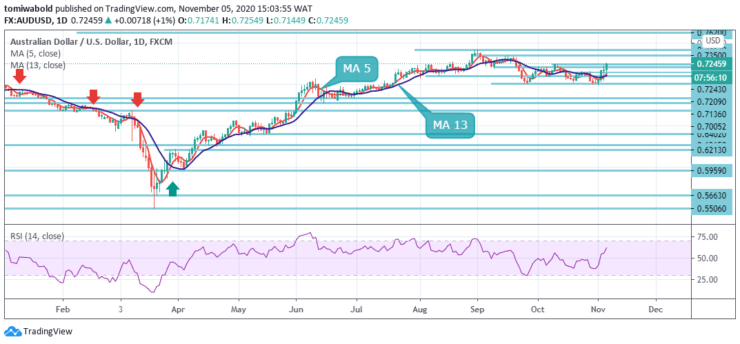

AUDUSD Price Analysis – November 5

The upbeat market mood further undermined the greenback pushing the AUDUSD to gain traction for the 4th day in a row above the 0.7200 marks. The ongoing steep decline in the US Treasury bond yields continued exerting some pressure on the US dollar and expectation of a Biden win.

Key Levels

Resistance Levels: 0.7620, 0.7413, 0.7243

Support Levels: 0.7136, 0.7005, 0.6832

The growing positive momentum on the daily chart is breaking through the 0.7243 resistance zone, and all being equal, the exchange rate may continue to surge during the next trading session. A potential target for the AUDUSD pair will be around 0.7300. However, the resistance cluster at 0.7350 could be a barrier for bull traders during this session.

Continuous trading back beneath the 5 and 13 moving average, which is now at 0.7100, would support the bearish sentiment and suggest that the bounce is over. The bias may shift to the 0.5506 low again. On the other hand, a break of the 0.7413 level would extend the gain from 0.5506 to 38.2% from 1.1079 (high) to 0.5506 (2020 low) at 0.7620.

The prior resistance from October highs, currently around 0.7243, limits short-term upside moves in AUDUSD, while bears are looking for a clear breach beneath the 0.7136 to attack the 0.7100 round number. The intraday bias for AUDUSD stays neutral for now.

On the other hand, a continuous breakout of the 0.7243 resistance level should validate the completion of the consolidation trend from the 0.7413 level. Intraday bias may be reversed if the 0.7413 high is retested first. On the other hand, a breach of the 0.7005 level may restart the correction to the 38.2% retracement from 0.5506 to 0.7413 at the 0.6684 levels.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.