EURUSD Price Analysis – April 23

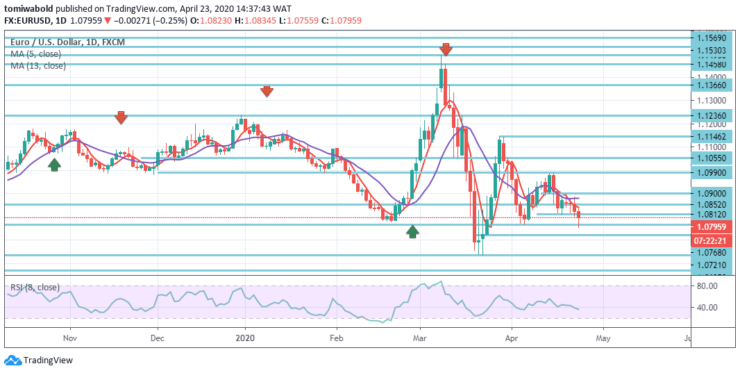

Moving into yet another significant Eurozone day, we have a minor negative sentiment that attempts to take control of EURUSD as it plummeted further extending losses underneath the recent low level at 1.0768. Markets are now shifting their focus to today’s meeting of EU leaders in an attempt to decide on how to stimulate the bloc economy after the epidemic.

Key Levels

Resistance Levels: 1.1496, 1.1146, 1.0990

Support Levels: 1.0721, 1.0635, 1.0569

EURUSD Long term Trend: Bearish

EURUSD extends the bearish tone into the second half of the week, posting new monthly lows beneath the level of 1.0768. When the pace of selling gathers steam, therefore, the low YTD level at 1.0635 (March 23) might be the next appropriate target.

The downward risk is anticipated to dissipate a little in the 1.0990/1.1055 region on an excess of the earlier highs. The drop to level 1.0635 may then be seen as the 3rd step of the trend from level 1.0339. In the above scenario, the trend may be rendered bullish for the long-term level of 1.2555 to be retested.

EURUSD Short term Trend: Bearish

The four-hour EURUSD chart on Thursday leads to the downside as bears stay in the forefront and moving beneath 5 and 13 Moving Averages, as well as the downside, maintains the momentum. Support for the near term awaits at level 1.0721 since that is the low of April.

It is supported by level 1.0635, however, on the way south in March was a stepping-stone. Several other resistance is at a low level of 1.0812 of last week, followed by a level of 1.0852, the daily high where the inability to continue may lead to a loss that could pave the way for continuation to main support at a level of 1.0635 (new three-year low 23 Mar).

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.