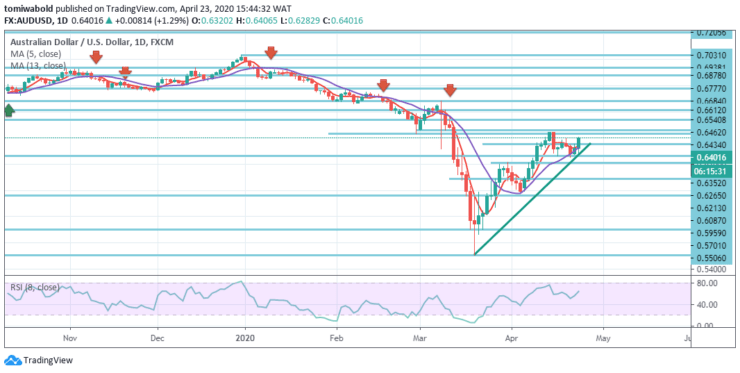

AUDUSD Price Analysis – April 23

The AUDUSD pair recovered about 85 pips from the recent swing lows and in the last hour jumped to multi-day highs, in the region of 0.6365-0.6400. A variety of factors supported the pair in reversing the Asian decline, quite prompting more dip-buying as greenback optimism trims down and turning positive for Thursday’s second successive session.

Key Levels

Resistance Levels: 0.7031, 0.6684, 0.6462

Support Levels: 0.6213, 0.5959, 0.5506

AUDUSD Long term Trend: Ranging

As shown on the daily, for now, the AUDUSD seems to be confined within a broad range of 0.6265 to 0.6400. We anticipate positional accuracy to become clearer until both extremes are substantively breached. However, the risk-reward seems to support a near-term upside-down rally.

A downward break beneath 0.6265 level is required to regain the top of March-end around 0.6213 level. Moreover, a 5 and 13 MA intersection level of 0.6330 and a monthly top level near to 0.6462 level may keep the pair upside defended in the near-term.

AUDUSD Short term Trend: Bullish

For the moment, the intraday bias in AUDUSD remains neutral. With 0.6213 support level unchanged, a further increase is slightly in favor. On the upside, the 0.6434 level breach may increase the recovery from 0.5506 level to 100% forecast from 0.5506 level to 0.6213 from 0.5959 level to 0.6684 level, which is a crucial resistance.

On the contrary, turned support breach of 0.6213 level would claim that such a rebound is complete. For validation, intraday bias may be adjusted back to the downside at 0.5959 support level.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.