EURUSD Price Analysis – April 13

EURUSD aims to extend on latest earnings at the start of the week, performing mostly to hold prices beyond 1.0900 level while losing traction ahead of key 1.1000 level towards the backdrop of lean market conditions due to Easter Monday’s break-in many European markets.

Key Levels

Resistance Levels: 1.1495, 1.1285, 1.1000

Support Levels: 1.0879, 1.0700, 1.0569

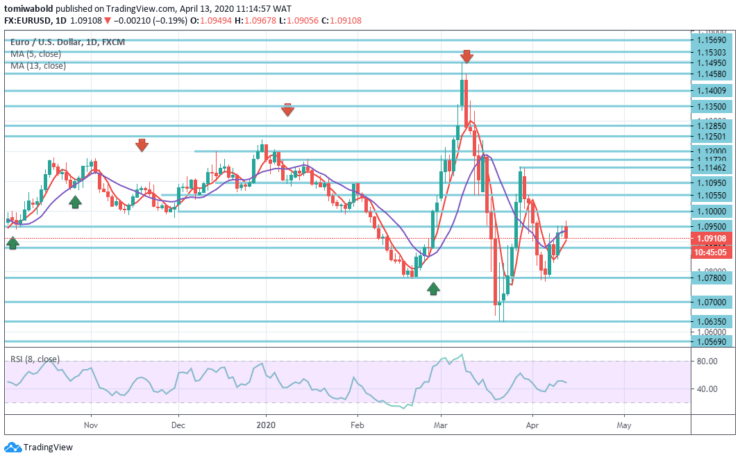

EURUSD Long term Trend: Ranging

The pair is currently losing 0.21 percent at level of 1.0910 and a break above level at1.1000 would target 1.1055 on the way to the level of 1.1095. On the other hand, instant claim emanates on the upside zones at 1.1146 level seconded by 1.1172 and ultimately 1.1200 levels.

On the downside, the 1.0879 breaks may restart the plunge to retest the low level of 1.0780. In this scenario, the trend is rendered bearish to re-test a low level of 1.0635.

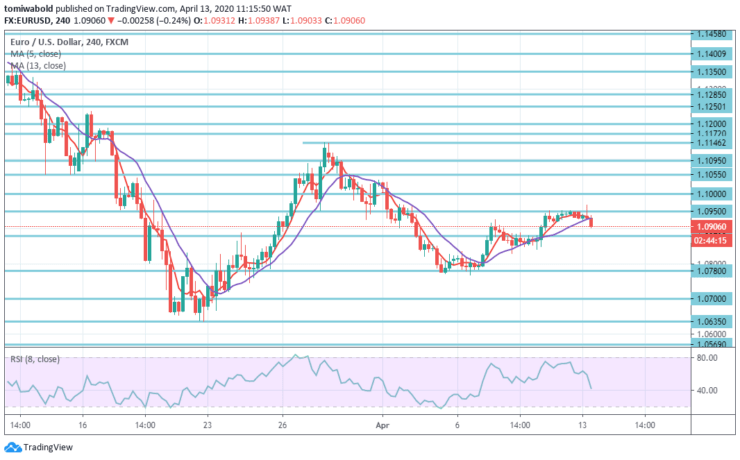

EURUSD Short term Trend: Ranging

For now, there’s no difference in the pattern on the 4-hour time frame. Another increase is slightly in favor as growth from the level at 1.0780 is seen as a corrective trend from the level at 1.0635. Intraday bias continues on the upside at 1.1146 level for a 61.8 percent retracement from 1.1496 to 1.0635 level.

On the downside, the break of the level at 1.0780 may resume falling to retest the low level at 1.0635. The consolidation tends to result in a swift loss of momentum and for today, the risk of a sustained advance in EUR is low.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.