EURUSD Price Analysis – November 4

The euro enlisted higher when the US dollar fell. The FX pair, albeit marginally unstable, was cited close to the recently settled highs. Financial data for the euro region is yet to be released. This left the greater part of the overwhelming effect in the US data release. Numerous reports have kept the dollar moderate.

Key Levels

Resistance Levels: 1.1450, 1.1412, 1.1280

Support Levels: 1.1026, 1.0923, 1.0879

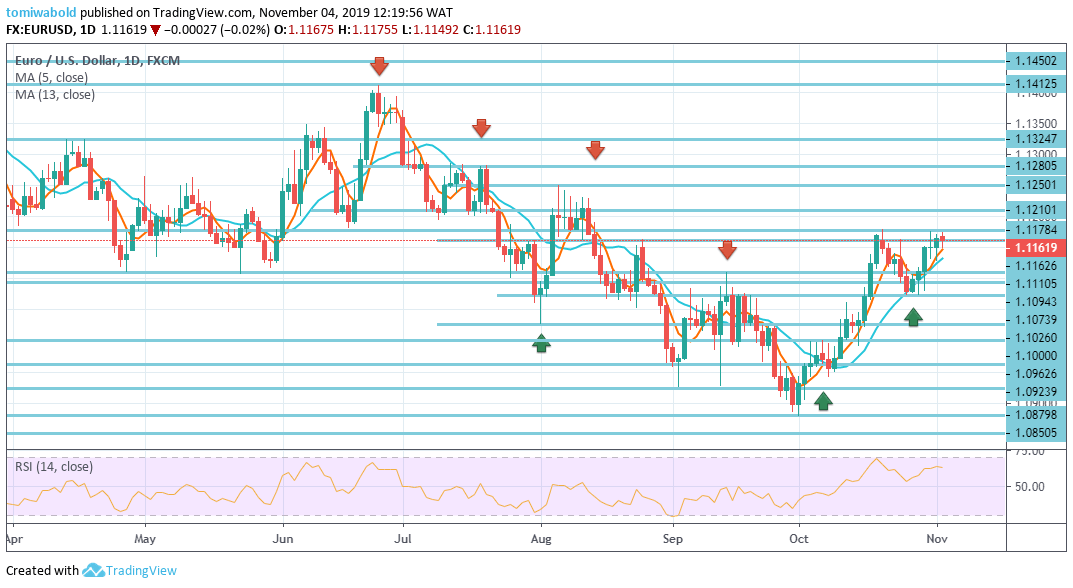

EURUSD Long term Trend: Bullish

In the long term trend, presently, the bounce back from the level at 1.0879 is viewed as a remedial move first. Thus, upside ought to be constrained by a retracement of the level at 1.1450 to 1.0879 at 1.1280.

Also, lower consolidation from a down pattern from the level at 1.1450 (high) would continue at a future point. Notwithstanding, a supported break of the level at 1.1280 may lessen this bearish pattern and establish a further advance of retracement to the level at 1.1450 next.

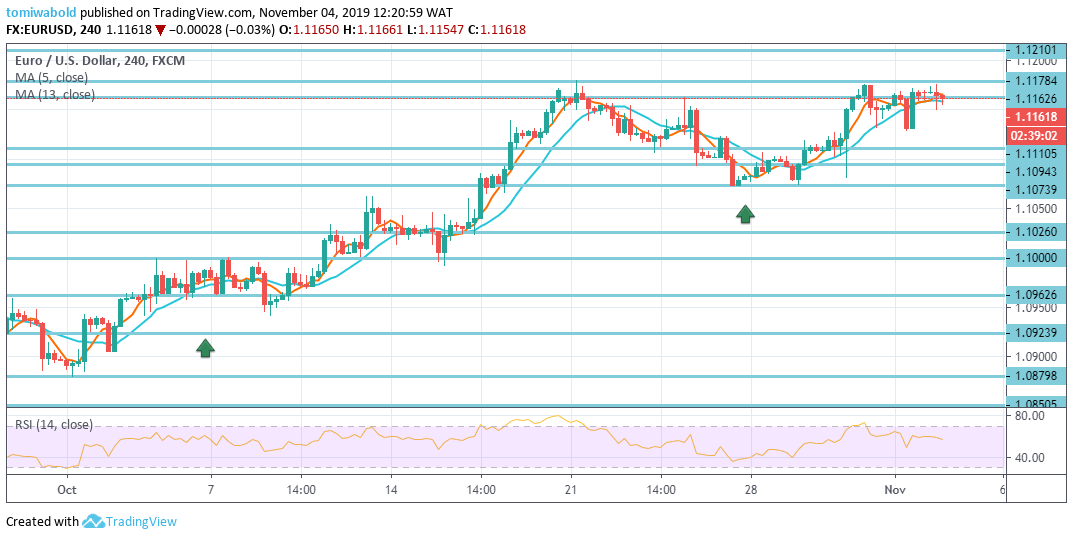

EURUSD Short term Trend: Ranging

The intraday bias in EURUSD stays neutral in the present and consolidation from the level at 1.1178 is likely to extend northwards. A further advance is probable with the level at 1.1026 support staying intact.

However, on the upside break of the level at 1.1178 may reactivate the bounce from the level at 1.0879 to 1.1412 key resistance. Moreover, a break of the level at 1.1026 downwards may ascertain that bounce from the level at 1.0879 has finished the retracement cycle. Then the intraday bias may turn back to the downside for retesting the level at 1.0879.

Instrument: EURUSD

Order: Buy

Entry price: 1.1178

Stop: 1.1026

Target: 1.1412

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.