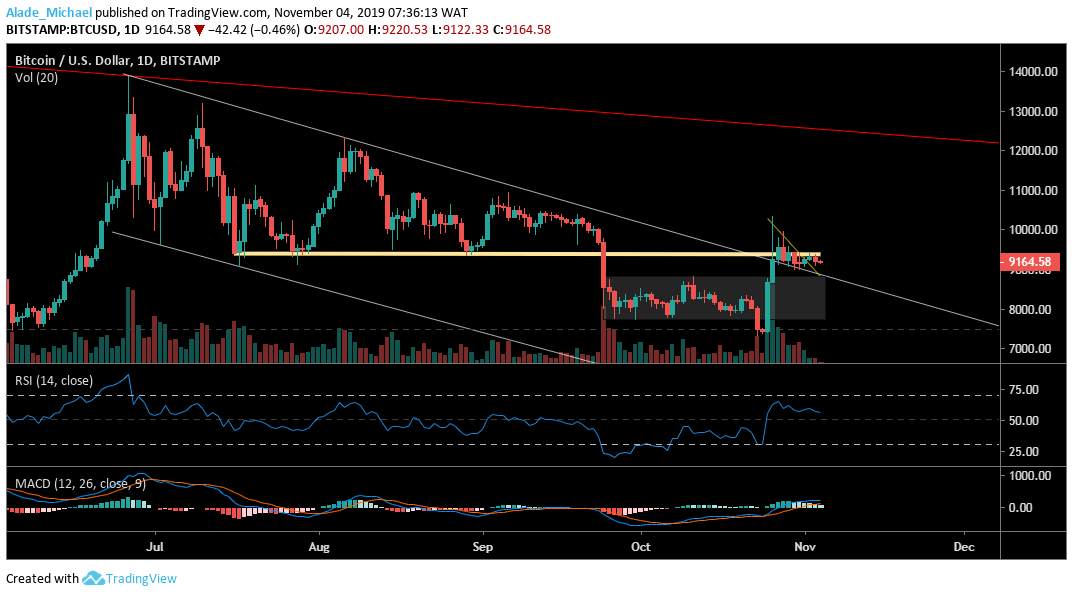

Bitcoin (BTC) Price Analysis: Daily Chart – Bullish

Key resistance levels: $9800, $10000, $10350

Key support levels: $9000, $8820, $8500

The October 25 spike renewed a bullish sentiment for Bitcoin but the calmness has recently made the market indecisive for the past few days. Of course, the reasons for the current price actions could be attributed to a lack of interest amongst traders. We may see a bullish trap if Bitcoin plummets back to the $8000 zones. Meanwhile, close support lies at $9000, $8820 and $8500.

Gaining value above the $9400 may rekindle the past week positive move as $9800, $10000 and $10350 would be the next long target for BTC. As we can see, the MACD is currently positive as well as their RSI, which is finding support at the 50 levels. This suggests that Bitcoin is still keeping a bullish momentum on the daily chart.

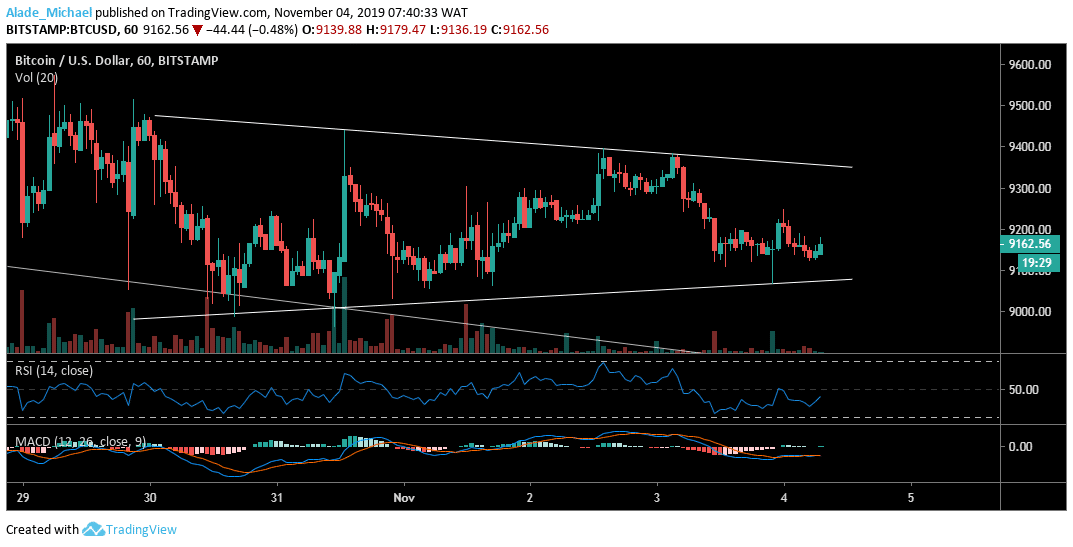

Bitcoin (BTC) Price Analysis: Hourly Chart – Neutral

The triangle formation is still making Bitcoin indecisive on the hourly chart. Yesterday, the price touched the lower boundary of the triangle and now we should expect a bounce to the upper boundary, where the $9350 resistance lies. Above the triangle, a quick rise should bring us to $9570 and $9800.

Below the triangle, Bitcoin may find support at $9000 – $8900, which has been a key rebound area for some days. More so, we can see that the RSI is rising back after seeing a sharp fall yesterday. Bitcoin is likely to gain strength as soon as the MACD leaves its negative zone.

BITCOIN BUY SIGNAL

Buy Entry: $9180

TP: $9350

SL: $8900

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.