EURJPY Price Analysis – January 29

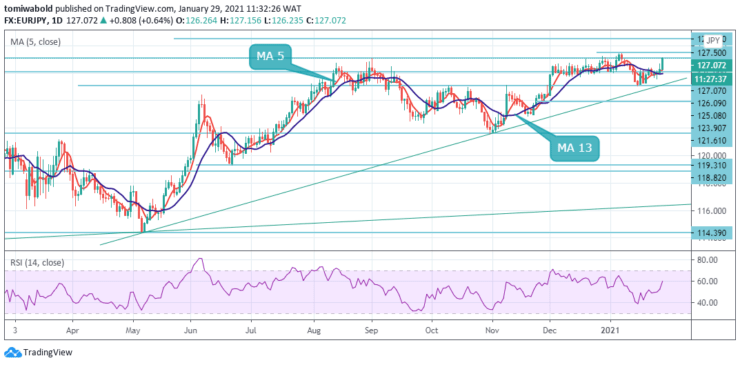

The common European currency has increased significantly for the 3rd day in a row against the Japanese Yen. At the back of renewed demand for the Euro, the upside momentum in EURJPY gained traction in the 125.00 zones while printing a high price past 127.00 in the present session.

Key Levels

Resistance Levels: 130.00, 128.50, 127.50

Support Levels: 126.09, 125.08, 123.90

The currency pair rebounded from the lower horizontal level around 126.00 during today’s trading session before moving north for the break of the 127.00 level. All things considered, the EURJPY exchange rate could continue upwards within the following trading session. Bull market investors are eager to force the market toward a level of 127.50.

However, if it recedes during the following trading session, a support cluster created by the moving average 13 and the ascending trendline below 126.00 level could further provide support for the currency exchange rate. Otherwise, sentiment in the event of a rebound may stay bearish.

The intraday bias in EURJPY remains mildly on the upside at this point. The present rebound from 125.08 would target a test on 127.50 high. On the downside, below 126.09 minor support will turn bias neutral again initially. The latest price activity further unlocked the path to a potential stay in the short-term timeframe to the 2020 highs in the 127.50 range.

As EURJPY remains vulnerable to an upward bias in the near term, a breach underneath the support level of 126.09 may deliver weakness towards the support zone of 125.08/121.61. On the other side, one can see resistance near the price level of 127.50.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.