EURJPY Price Analysis – May 22

The common European currency has dropped significantly since yesterday’s trading session by 116 pips or 0.98 percent against the Japanese Yen. At the back of renewed demand for the safe-haven JPY, the upside momentum in EURJPY lost traction in the 118.52 Zone. Other things considered, the exchange rate for EURJPY may start to fall beneath.

Key Levels

Resistance Levels: 122.87, 121.15, 119.00

Support Levels: 117.08, 115.54, 114.39

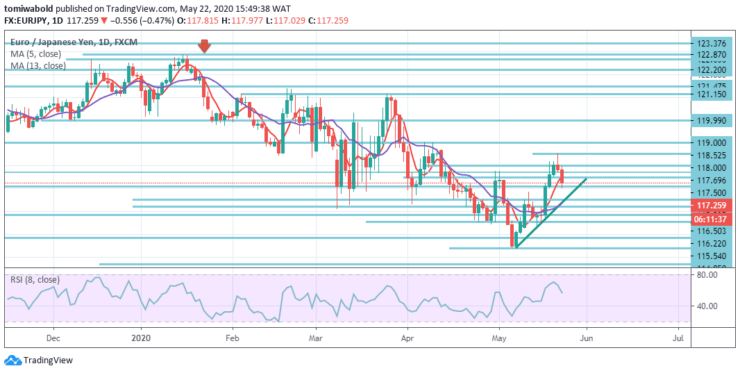

EURJPY Long term Trend: Bearish

EURJPY ‘s recent bullish run simply stopped far above the MA 5 around the level at 118.52 aftermarket volatility gained footing from the 115.83 level, on the lower range of the moving average upside crossing and the horizontal support line.

Besides, the rising moving average of 5 and 13 and the impending bullish overlap of the ascending trendline are backing a positive outlook. However, should buyers take the upper hand and extend above the 118.52 level, the significant 119.00 and 119.99 high levels could draw traders’ attention ahead of the 121.15 high level from the end of March.

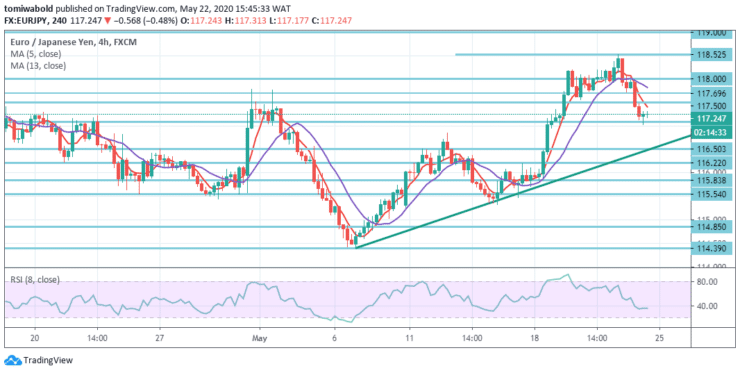

EURJPY Short term Trend: Ranging

EURJPY is trading past the upward trendline on the four charts which indicates a bullish bias. Nevertheless, in the previous session the market lost some momentum and it needs to be certain if there is any gas left in the tank at the spot.

The next zone of resistance is seen close to the price levels of 118.52/119.00 preceded by the level of 119.99. On the other hand, a short-term split underneath the level of 117.00 may also lead to a downward acceleration towards lower levels. Instant support can be seen close to levels 116.50 and 116.22.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.