EURJPY Price Analysis – October 22

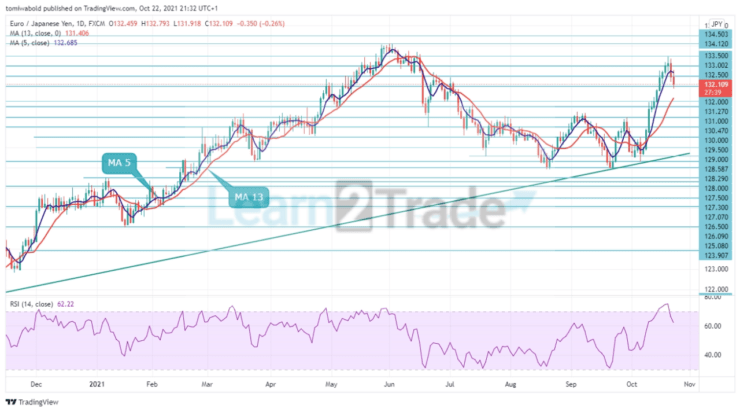

EURJPY weakens shy of the 134.12 June high in the prior day, the needle-like gain appears to have run into some resistance near around 133.72 on Thursday, resulting in a minor corrective fall. The cross corrected lower on Friday following the existing bias for a modest corrective fall. Price action was unfavorable, as seen by declining US stock indices of 0.06 percent to 0.41 percent, except the Nasdaq Composite, which rose 0.27 percent.

Key levels

Resistance Levels: 134.50, 133.50, 132.50

Support Levels: 132.00, 131.50, 131.00

On Friday, the EURJPY opened lower at 132.45 and moved higher to 132.79. The pair retreated, as bears emerged and traders focused on levels below 132.00. To investigate the bearish scenario, a decisive fall below 132.00 must be established. The pair may continue to fall, with bearish traders targeting the below 132.00 area as a possible objective.

Growth from 125.08 is considered as a mid-term phase of growth inside a long-term consolidation trend in a broader perspective. As long as the 128.00 support level holds, more gains are expected. A strong breakout of 128.00, on the other hand, would confirm that the rebound from 125.08 has come to an end, bringing this low back into focus.

The EURJPY is still trading in a range from its high of 133.48, and the intraday bias is still to the downside. If the former barrier at 132.00 holds as support, the further climb is likely. A decisive rebound past 132.50, on the other hand, will restore entire gains from 128.00.

The mid-term level of 133.50 will be the next aim. A break of revised support at 132.00, on the other hand, might reverse the uptrend and broaden the range from 133.50 with a new phase of drop.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.