Market Analysis – March 21

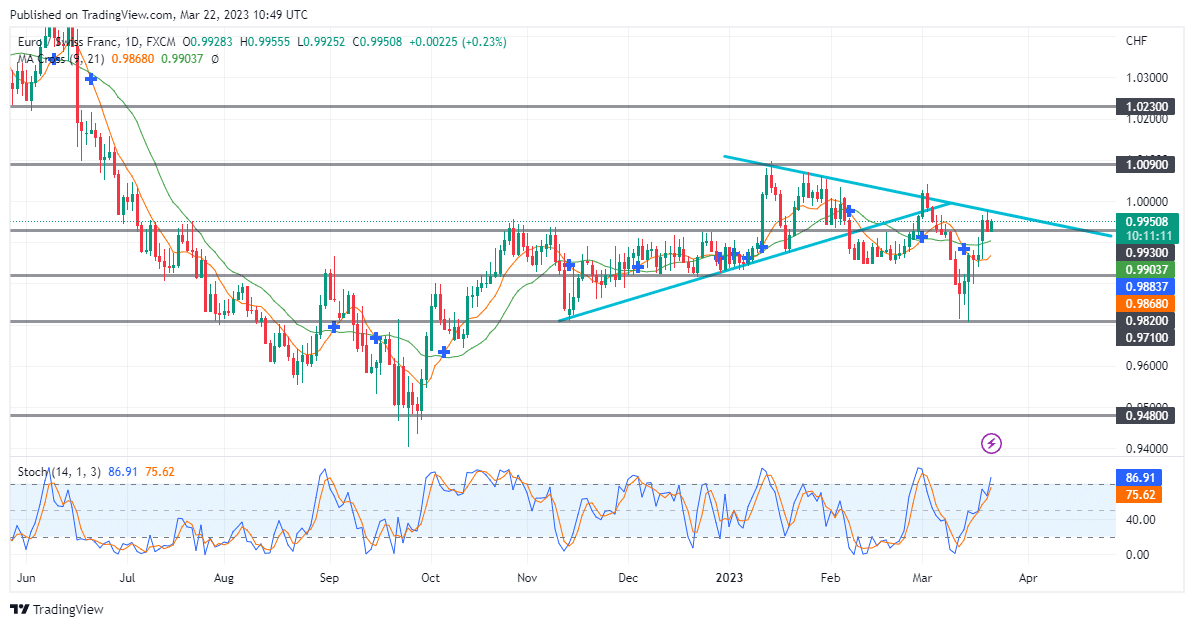

The EURCHF market experienced a decline in price from June to September of the previous year. The continuous expectation for a bullish reversal failed until the demand level of 0.9480 was tested. The market has resumed another bearish trend on the higher timeframe.

EURCHF Key Levels

Demand Levels: 0.9820, 0.9710, 0.9480

Supply Levels: 0.9930, 1.0090, 1.0230

EURCHF Long-term Trend: Bearish

EURCHF ascent started in September with three white soldiers leading the market away from the 0.9480 key level. The ascent continues after a pullback to test the Moving Average period nine after it swerved above the Moving Average period twenty-one. The market rose consistently with the aid of an ascending trendline anchored on the 0.9710 support level.

After the test of the key level of 1.0090, a large double-top pattern formed to signal a bearish reversal in the market. The test of the bearish trend line caused a descent to 0.9710.

EURCHF Short-term Trend: Bullish

The market has ascended to test the bearish trendline. The Stochastic shows the market is overbought on the daily chart and the four-hour chart. The price is expected to sink to the 0.9820 key level.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.