Market Analysis – March 14

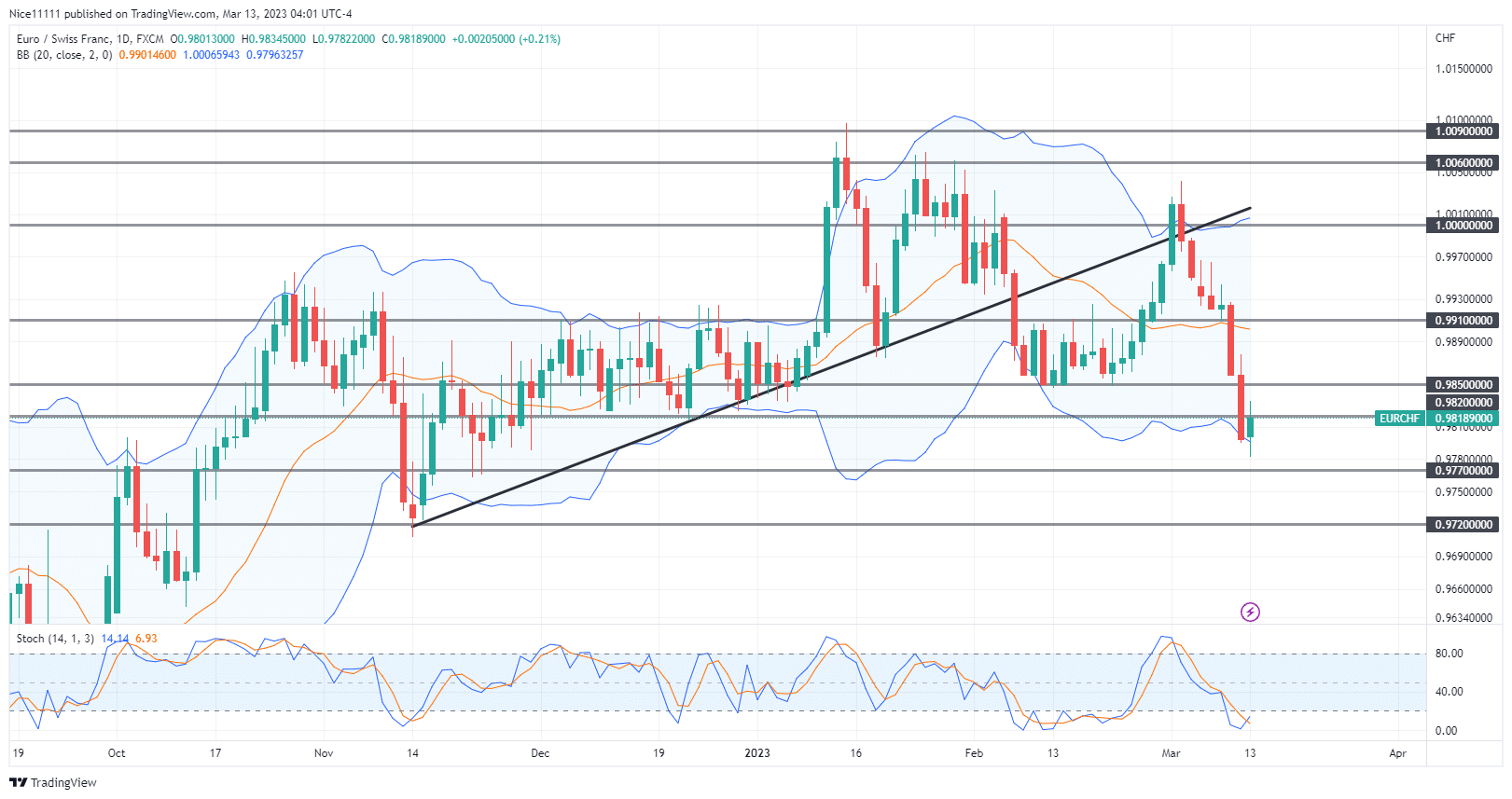

EURCHF market ascended with the aid of a bullish trendline until 1.0090 was reached. The market has turned bearish after the break of the bullish trendline.

EURCHF Key Levels

Demand Levels: 0.9820, 0.9770, 0.9720

Supply Levels: 1.0000, 1.0060, 1.0090

EURCHF Long-Term Trend: Bearish

EURCHF ascended from a bullish order block at the demand level of 0.9720. The daily candles pushed beyond the Lower Bollinger Bands to reveal the market was oversold. This correlated perfectly with the Stochastic Indicator which revealed the market was

oversold. A rapid takeoff was noticed afterward. The candles bounced on the ascending trendline in January after a short-term consolidation.

After striking the oversold level of 1.0090, the selloff by the whales caused the price to decline rapidly in January. The second strike of the trendline caused the break in February. The market ascended to 1.0000 for a retest of the ascending trendline. The Stochastic showed the market was overbought as the resistance Bollinger Band prevented further rises.

EURCHF Short-Term Trend: Bearish

The market is in a downward spiral. Since the retest of the ascending trendline, the market has continued to dip. The market is currently diving to the support level of 0.9770.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.