Market Analysis – May 9

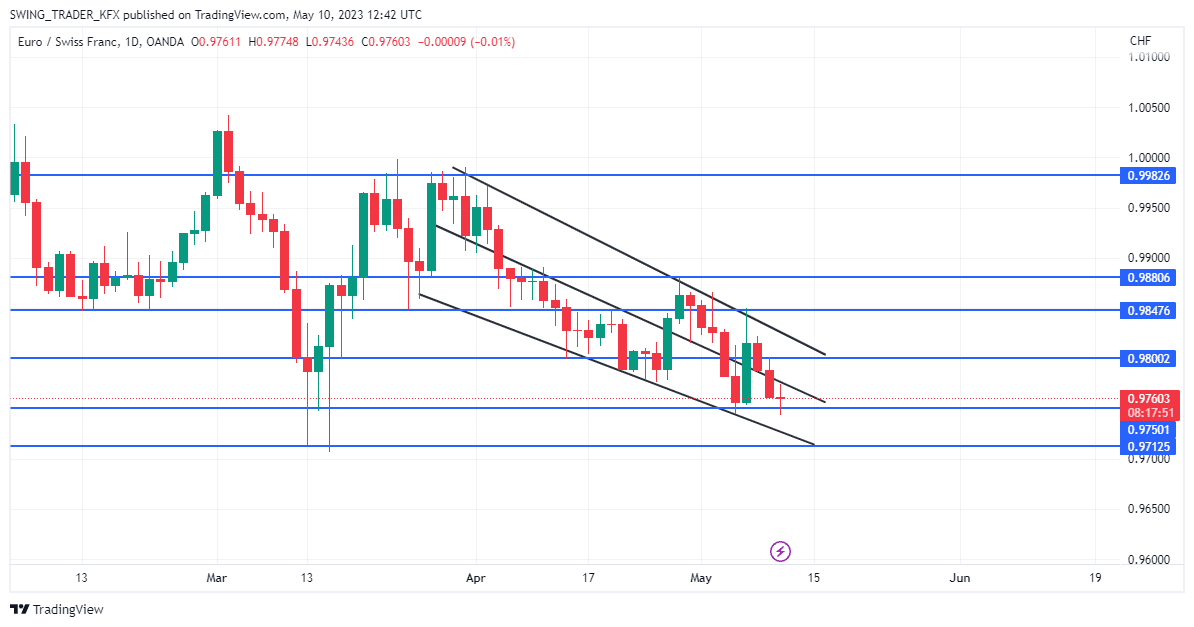

EURCHF price action has abounded within the range of the high and low formed by the impulsive bearish swing in March. The price declined aggressively from 0.99820 to 0.97125. At the inception of March, the market experienced eight consecutive days of an impulsive price decline. The price has not ascended beyond the high or descended below the low of the impulsive move.

EURCHF Key Levels

Demand Levels: 0.98000, 0.97500, 0.97120

Supply Levels: 0.98470, 0.98800, 0.98820

EURCHF Short-term Trend: Bearish

EURCHF turned bearish on the 12th of March after a price decline below the equal lows of 0.98470. Multiple rejection candles with very prominent wicks rested at the supply level of 0.97120. A retracement followed immediately to cover up the fair value gap deposited due to the speed of the market’s repricing.

A bearish parallel channel has been used to define the price action after the retracement. The upper border of the bearish channel was tested by a large bullish candle. The resistance trendline has fostered a price decline to the support level of 0.97500.

EURCHF Short-term Trend: Bearish

EURCHF has broken the low of 0.97500. The break of structure signals a future decline in price. The market is expected to dive to the 0.97120 support level.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.