Market Analysis – May 4

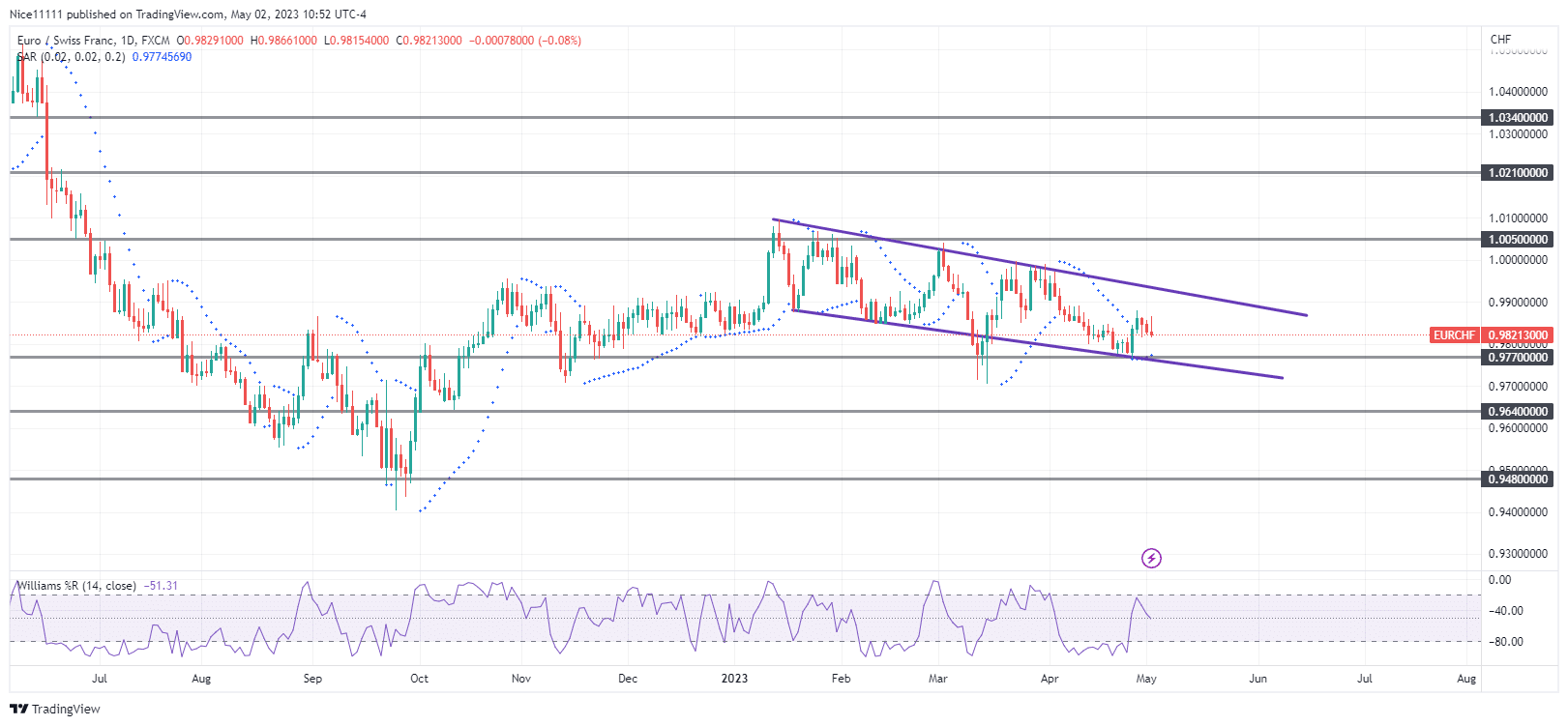

The market trend is well defined by the downward-sloping channel on the daily timeframe. The demand level of 0.9770 halted the descent of the price, causing a false breakout and an abrupt reversal in March. The demand level is still well-defended, as the price decline was stopped upon the test in April.

EURCHF Key Levels

Demand Levels: 0.9770, 0.9640, 0.9480

Supply Levels: 1.0050, 1.0210, 1.0340

EURCHF Long-term Trend: Bearish

The month of December was characterized by consolidation. The silent moment of price, usually followed by wild expansions, has been experienced this year. A lower high formed after the test of the 1.0050 supply zone to reveal a failure swing. The two highs formed a double top. With the break of the neckline, the market turned bearish.

The sudden upthrust after the consolidation was eventually not the direction of the market in 2023. Hence, the push-up in price after the consolidation is a manipulation after accumulation. The distribution followed the manipulation to the downside.

EURCHF Short-term Trend: Bullish

EURCHF Short-term Trend: Bullish

A bullish SMS (shift in market structure) has been observed in the 4-hour timeframe. The Parabolic SAR (Stop and Reverse) also signals a bearish trend. The descent is excited to resume upon the test of the resistance trendline.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.

EURCHF Short-term Trend: Bullish

EURCHF Short-term Trend: Bullish