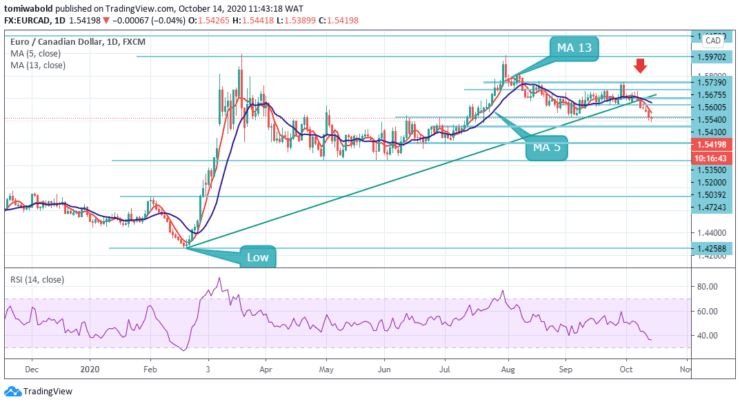

EURCAD Price Analysis – October 14

The common European currency has declined by approx 150 pips from the start of the week against the Canadian Dollar. The continuation of the downside bias in EUR comes in response to the risk aversion scenario sustained by rising uncertainty in the European markets. All things being equal, EURCAD downside breakout halts upside move, trades around 1.5400 level.

Key Levels

Resistance Levels: 1.5970, 1.5739, 1.5540

Support levels: 1.5350, 1.5200, 1.5039

EURCAD made a firm decline below the lower corrective channel line connected from the 1.5400 level, which is a confirmation that the correction of a bigger upside impulse has commenced. That said, a break below the ascending trendline now offers another evidence that bears are on the move.

If the pair continues to fade, early tough support may originate from the 1.5200 level. Ebbing past this zone may test the 1.5039 zone limiting section before the pair dips towards the nearly 7-month low of 1.4724 level. Additional weakening may then see the price target the 1.4259 troughs, from February 20.

On the 4-hour time frame, bearish traders could target a support cluster at the 1.5350 level. However, the currency exchange rate might make a brief pullback towards the round figure pivot at 1.5600 level the shorter term.

In brief, the short-term picture seems to be skewed to the downside as the price remains below the moving average 5 and 13. A break above the 1.5430 level may shift the bias neutral-to-bullish. However, a further fall is still expected as long as the 1.5430 support turned resistance level holds.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.