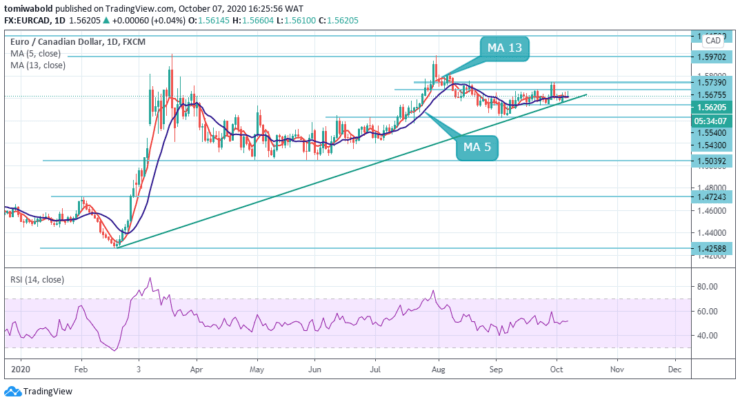

EURCAD Price Analysis – October 7

The EURCAD currency pair seems to be giving out upside continuation signals across the board toward the 1.5700 level, in particular on the higher time frames. A tweet from US President Trump caused a downturn in the equities markets and sent the US dollar higher. Oil markets were having another heady session until hitting a brick wall when President Trump called off stimulus talks.

Key levels

Resistance Levels: 1.5970, 1.5739, 1.5675

Support levels: 1.5540, 1.5415, 1.5039

EURCAD advanced considerably away from the last period following the bounce off the daily moving average 5 and 13. The RSI is extending its movement above its midlines to the positive territory. More upside pressures could lead the bulls to reach the 1.5675 barriers, taken from the high on September 25.

On the other hand, a drop below the ascending trendline support followed by a 1.5540 horizontal support level could take the price to the 1.5430 support before challenging the 1.5400 marks. Steeper decreases could switch the near-term bias to bearish, hitting 1.5039 level.

Despite dipping to sub 1.5600 level EURCAD failed to sustain below 1.5540 resistance turned support level and recovered. Intraday bias remains neutral first. On the upside, of 1.5675 level will resume the rebound to 38.2% retracement of 1.5739 to 1.5430 at 1.5540 levels, as a correction to the whole fall from 1.5970 level.

However, a sustained break of 1.3259 level will indicate the completion of the rebound from 1.2994 level. Intraday bias will be turned back to the downside for retesting this low.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.