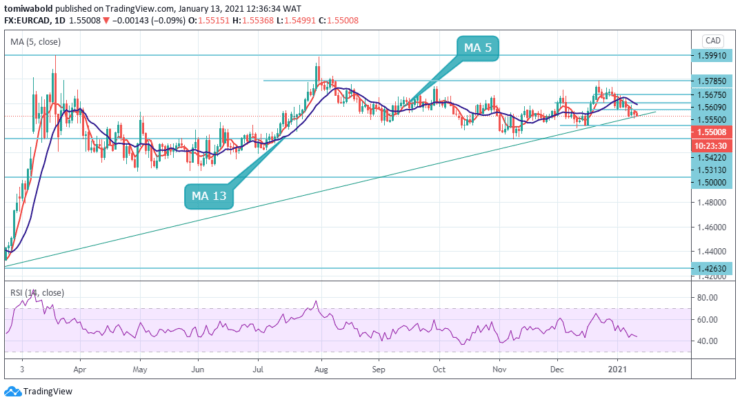

EURCAD Price Analysis – January 13

The EURCAD pair trades under the 1.5550 level after meeting a strong barrier at the 1.5785 level in an upside correction. EURCAD is slipping to sellers’ territory and well on its way for prospects of a price correction. Crude oil made a new swing high and at the same time, CAD may see some upside.

Key Levels

Resistance Levels: 1.5785, 1.5675, 1.5609

Support levels: 1.5422, 1.5376, 1.5200

The emergence of some fresh CAD buying, in turn, was seen as one of the key factors that capped the upside for the EURCAD pair beneath the 1.5550 level. The downside, however, remained cushioned on the back of weaker crude oil prices at the 1.5422 level. In the larger context, a fall from the 1.5785 level is seen as the 3rd phase of the corrective pattern from prior highs.

The rejection by the moving average 5 is keeping the trend bearish. But we’d expect a loss of downside momentum as it approaches the key support at the 1.5422 level. On the upside, a firm break of the 1.5550 resistance level is needed to indicate a price rebound. Otherwise, the trend may continue to consolidate in case of a rebound.

EURCAD intraday bias remains neutral as consolidation continues from the 1.5785 high. On the other hand, a breach lower of 1.5500 would target the 1.5422 low level. The breach will resume the stronger fall from the 1.5970 level.

However, a break higher of the 1.5550 resistance level will extend the consolidation pattern from 1.5389 with a new phase of growth. Instead, the intraday bias will be directed up towards the 1.5609 level. Besides, the likelihood of a short-term trading stop being triggered above the level of 1.5675 contributes to its increase.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.