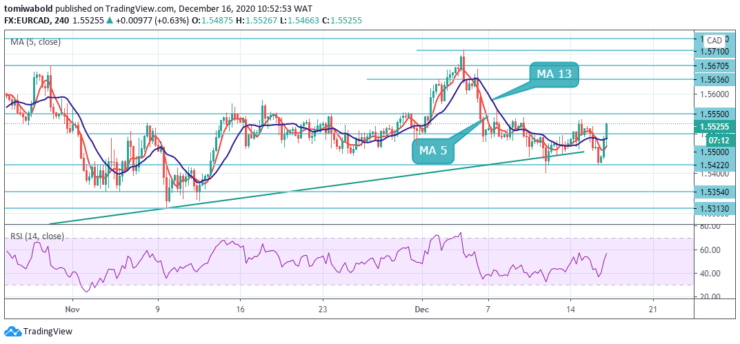

EURCAD Price Analysis – December 16

EURCAD is currently trading between moving average 5 and 13 after a bounce past the 1.5500 level during the European session on Wednesday. CAD appears to have received dents from comments of the BOC deputy governor that economic recovery is at a very difficult stage as rising Covid-19 infections will dampen growth.

Key Levels

Resistance Levels: 1.5710, 1.5637, 1.5550

Support Levels: 1.5422, 1.5354, 1.5247

As seen on the daily time frame, the rebound of the price comes after a drop from a recent high of 1.5366 level to a 1.5422 temporary low. The trend though leans slightly towards an improving picture towards the 1.5550 level. Backing this view is the squeeze of price within the moving average of 5 and 13.

EURCAD is also attempting to breach 1.5447 moving average 13 to validate its rebound from the 1.5422 level. A rejection there may target a test on 1.5313 low level. Also, such a decline will be seen as the third phase of the corrective pattern from 1.5970 level, breach of 1.5313 level should bring a test on lower channel support now at 1.5247 level.

Currently, the exchange rate is trading near the upper boundary of the sideways channel at the 1.5526 level and could be set for a breakout. If the channel resistance holds at the 1.5550 level, a decline towards the 1.5354 level could be expected within this week’s trading sessions.

However, if the EURCAD pair breaks the sideway channel pattern, upside buy stops will get triggered and bullish traders would drive the price towards the near term resistance level at 1.5710 during the following trading sessions.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.