The currency pair could see more drops.

The bears may take the leading in a short while.

EURAUD Weekly Price Analysis – September 21

The EURAUD pair is on the verge of more drops. A downward turnaround in the currency pair market is imminent. The pair price is moving close to the lower support level and is ready to enter a negative phase. Consequently, if the short traders increase the selling momentum, the price may experience further slumps and its drops may reach a prior low of $1.63 and extend to the $1.61 lower support mark, suggesting a strong entry point for sell traders.

EURAUD Market

Key Levels:

Resistance levels: $1.78, $1.79, $1.80

Support levels: $1.63, $1.62, $1.61

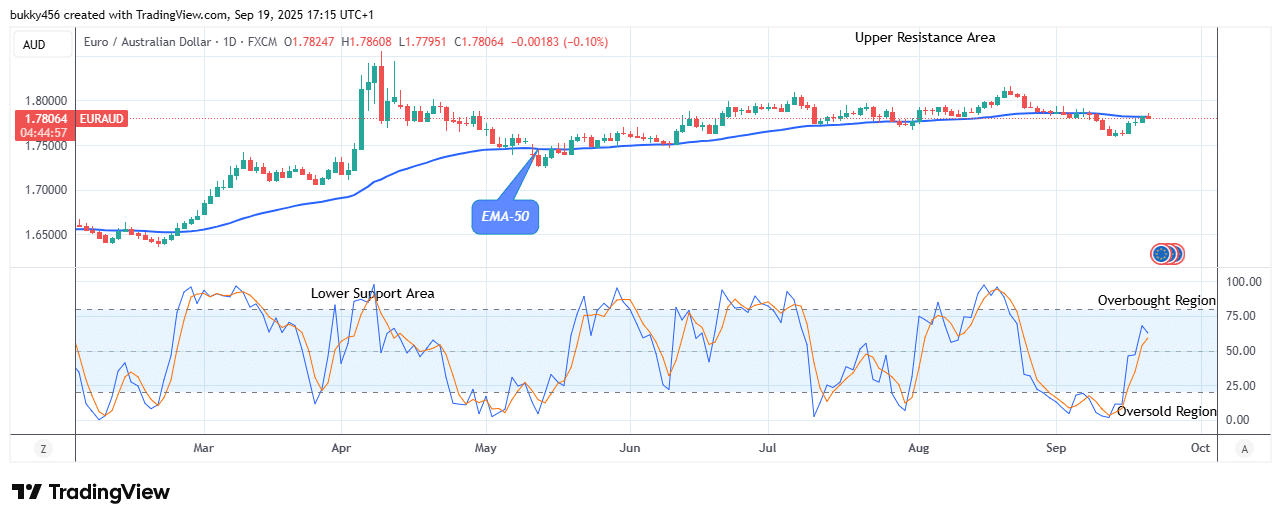

EURAUD Long-term Trend: Bearish (Daily Chart)

In the long run, the EURAUD market is in a bearish posture and may continue the downward retracement.

The sell traders’ downward move to the $1.77 support level in the past few days has contributed to its recent drop in price. Hence, the currency pair is approaching the lower support, and a breakdown is imminent.

The EURAUD price dropped even further today, reaching a low of $1.76 below the supply levels as a result of the sell traders’ actions.

However, if a renewed surge in sellers’ interest occurs, the pair price may experience further downturn to the prior low barrier at $1.63 low level, providing short traders with a good entry point.

Notably, the EURAUD pair could see more drops as indicated by the daily projector pointing downwards.

As a result, the selling pressure may reach the $1.61 lower support mark in no long time as the pair resumes and continues the selling momentum in the higher time frame.

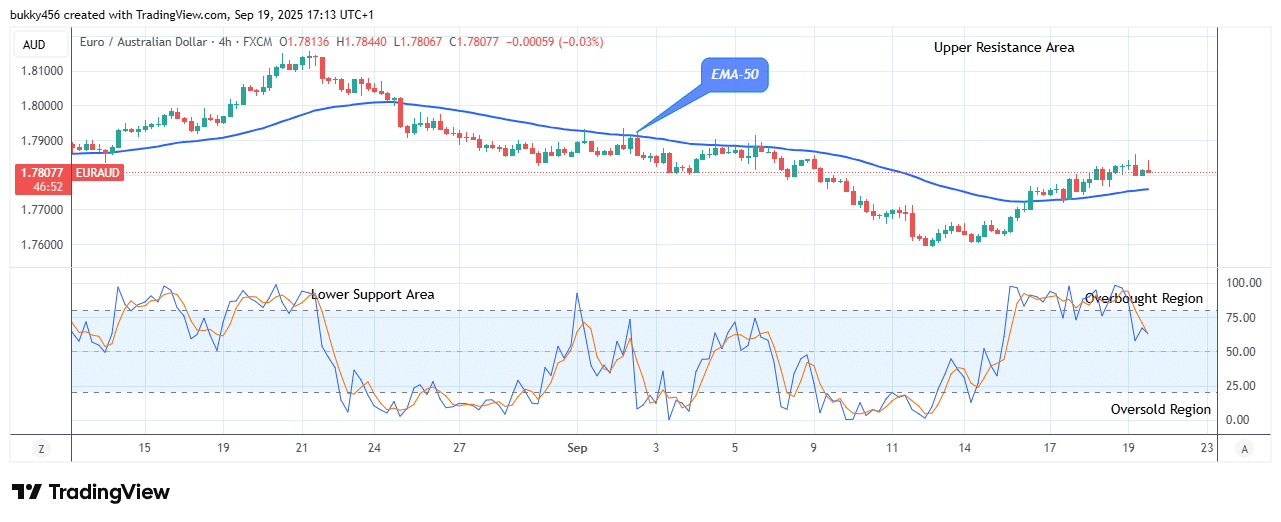

EURAUD Medium-term Trend: Bullish (4H Chart)

EURAUD price is bullish on the medium-term outlook. Meanwhile, the pair anticipates a downward trend as the bears resume the selling momentum. The price action is above the moving averages, suggesting a bullish trend.

Today, the EURAUD sellers took the journey down south at the $1.78 support mark above the EMA-50, as it begins the negative move, shortly after the commencement of the 4-hourly chart, anticipating a bearish trend soon.

Hence, if the bearish correction phase persists, the selling pressure may drive the pair price to retest the $1.75 previous low barrier, indicating a growing selling pressure.

Additionally, the short traders anticipate a downward trend soon, as suggested by the daily signal pointing down.

In light of this, the sell traders may continue the negative correction, and the target might be the $1.61 lower support mark in the days ahead as the pair anticipates more drops in its medium-term perspective.

Note: Learn2.Trade is not a financial advisor Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.