The currency pair anticipates more upside.

The bulls may take the leading soon.

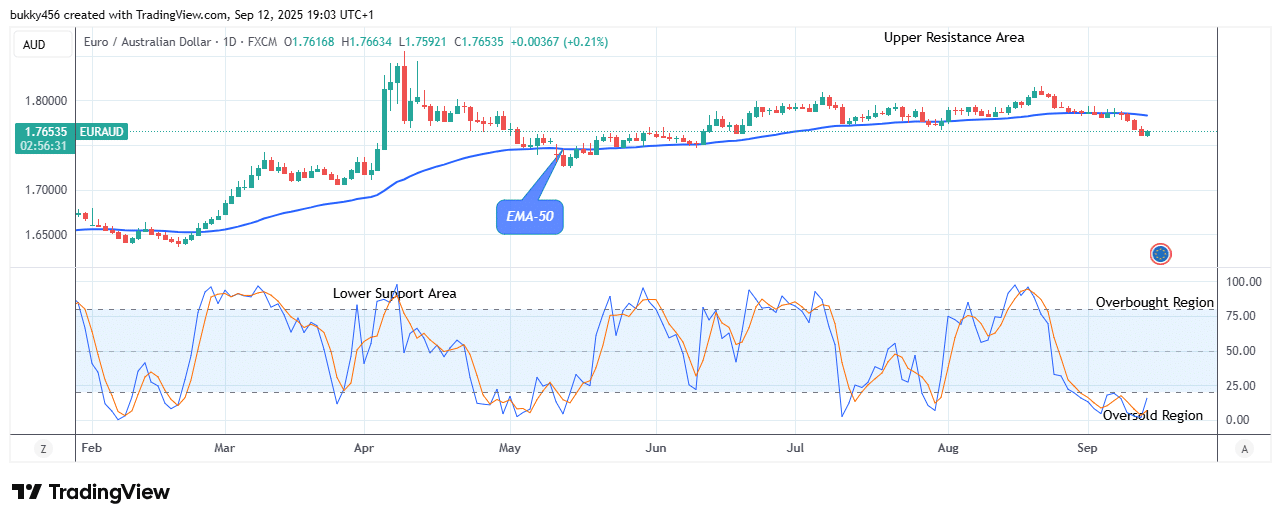

EURAUD Weekly Price Analysis – September 14

The EURAUD pair is ready for the next upbeat trend, as usual, after updating lows. The currency pair is rising, and it may break the $1.84 resistance level if all support level holds. However, the pair price may swing to retest the previous high and perhaps rise as high as $1.90 upper resistance mark, resulting in a greater opportunity to buy the currency pair.

EURAUD Market

Key Levels:

Resistance levels: $1.83, $1.84, $1.85

Support levels: $1.59, $1.58, $1.57

EURAUD Long-term Trend: Bearish (Daily Chart)

From a long-term perspective, the EURAUD pair is in a bearish trend. The price is currently in a negative market since it is trading below the EMA.

However, the bulls are prepared for the next positive trend and will push the price higher.

At the time of writing this article, the EURAUD price responded to the shift in market structure and is currently below the moving averages at the $1.76 resistance as the daily chart opens today.

The currency pair has the ability to rise further to retest the $1.84 previous barrier as it starts its bullish correction pattern, providing vigorous resistance to the price of the pair, provided there is significant purchasing pressure and optimistic market sentiment.

The daily stochastic remains in an upward trend, suggesting a bullish continuation, which will enable the bulls to sustain the rally and may soon lead to the long-term forecast of $1.90 resistance trend line or higher.

EURAUD Medium-term Trend: Bearish (4H Chart)

EURAUD price is bearish on the medium-term time frame. The price bar is in green below the moving averages, due to the influence of the sell traders.

However, the bulls are about to swing the currency pair price to a higher level as a new correction has taken place below the trend levels.

The current price of the EURAUD pair at $1.76 high below the EMA-50 as the 4-hourly session opens today indicates investors’ optimism to increase the potential, and this may break the crucial resistance level.

Thus, buyers will have a solid basis to push the pair price higher with a 4-hour candle closing and an upward breakout above the $1.81 barrier, offering buyers a great opportunity to enter the market and place a trade.

Additionally, the current correction phase may continue as indicated by the momentum indicator pointing upward.

Hence, the bulls may continue their bullish correction and maintain their dominance in the long run to break through the previous barrier and a significant level of $1.90 supply trend line in the days ahead.

Note: Learn2.Trade is not a financial advisor Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.