Inflation in the euro area just can’t seem to shake off its stickiness, making headlines once again with the finalized data for April. The numbers revealed a slight uptick in the headline print compared to the same period last year. However, when we removed the more volatile price items like food and fuel to get a clearer picture, we saw a tiny drop from 5.7% to 5.6%.

However, month-on-month (MoM) inflation showed signs of moving in the right direction, with 0.6% price growth. Though not a huge number, it’s not negligible, especially when compared to the previous month’s 0.9%.

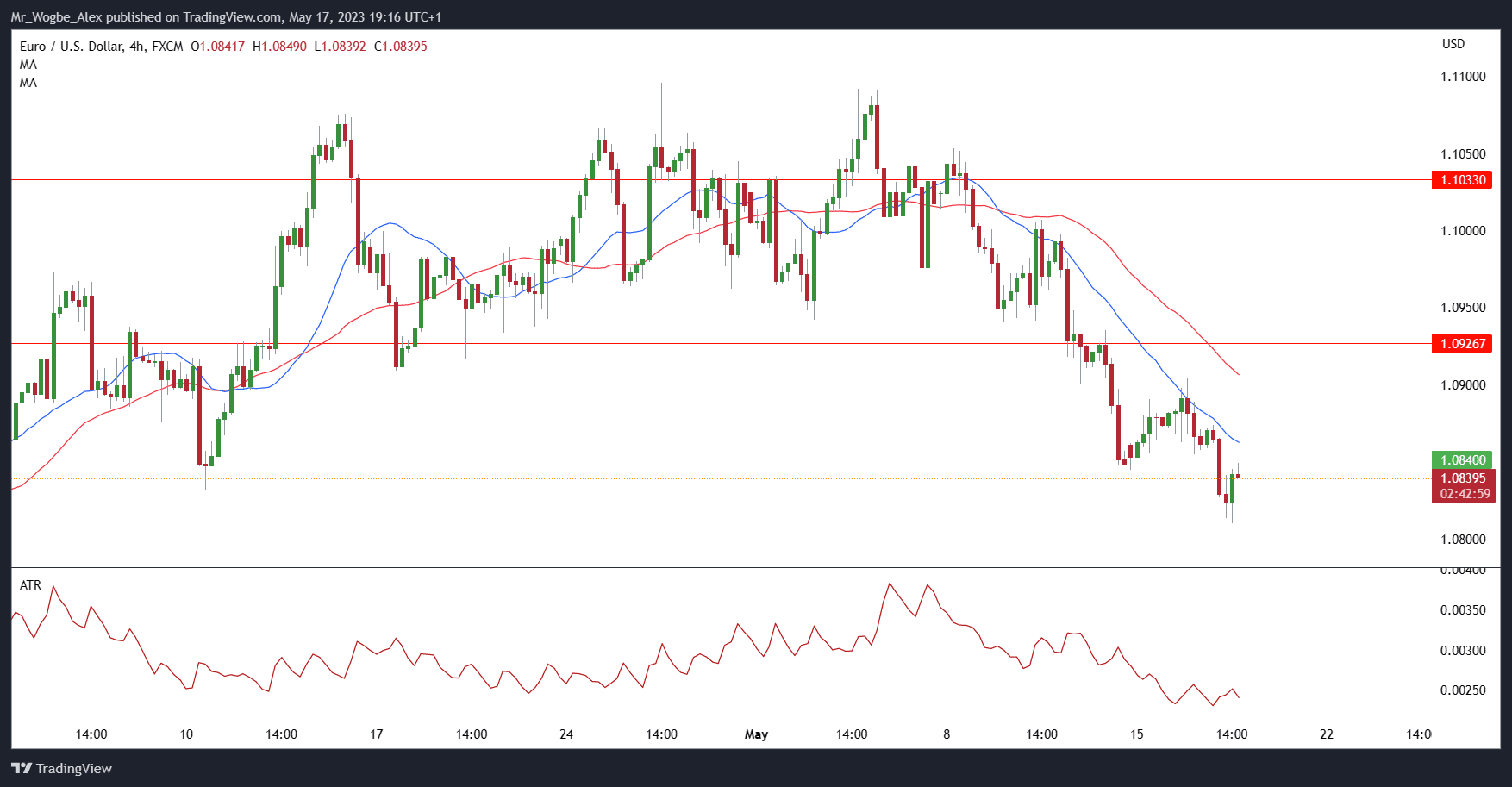

EUR/USD Maintains a Downward Trajectory

Now, to the EUR/USD currency pair, which took a bit of a tumble after the final inflation data came out. The pair has been going downhill for a while now as pressure keeps piling up due to the whole US debt ceiling situation. No wonder the dollar has picked up a rather sizeable bid, flaunting its safe-haven qualities while the deadline looms.

But wait, there’s more! Another bearish influence weighing on the EUR/USD pair is the recent hawkish speech by the Federal Reserve. It turns out that the University of Michigan consumer sentiment survey revealed higher long-run inflation expectations among US citizens, and the Fed wasn’t too thrilled about that. However, let’s not get too carried away with the drama because weaker manufacturing data from America’s east coast suggests that the overall economic picture is a mixed bag.

Weak Chinese Economic Trade Data and Inflation Figures Exerts Additional Pressure on the Euro

In other related news, weak Chinese import and export data, along with disappointing inflation figures, have cast a shadow on the positive economic influence anticipated from the grand reopening. China, being a major trading partner with the EU, holds significant sway over the euro. So, when China’s economic engine sputters a bit, it’s only natural for the euro to feel the weight of that weakness.

All in all, the euro finds itself facing challenges on multiple fronts, including stubborn inflation, US debt ceiling uncertainties, and China’s economic woes.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.