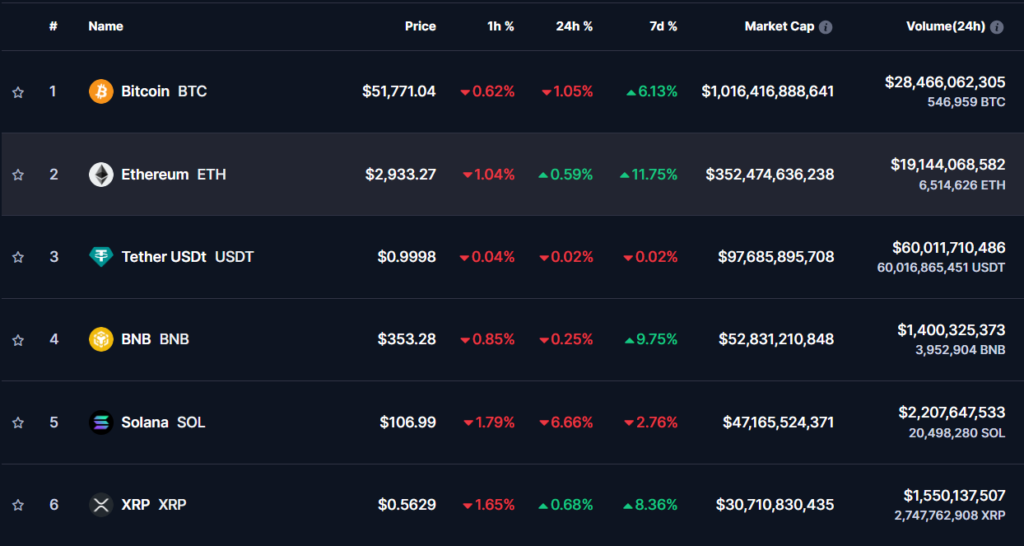

The Ethereum native cryptocurrency, ether (ETH), surged past the $3,000 price level today for the first time since April 2022. ETH gained over 11% in the past seven days (CoinMarketCap data), significantly outpacing Bitcoin and other major counterparts.

This impressive rally has been attributed to growing excitement around a potential US regulatory approval for spot ETH exchange-traded funds (ETFs).

Organizations such as Standard Chartered and brokerage firm Bernstein predict that there is a good chance of spot ETH ETF approval by May. This would enable more mainstream investors to gain exposure, boosting demand.

Ether now trades just under $3,000 at the time of writing, its highest level since the 2021–2022 crypto crash. The previous all-time high above $4,868 was set in November 2021.

Ethereum Traders Target $3,500–$3,600 in the Near Term

ETH has room to advance further in the short term. Traders are targeting $3,500 next, followed by $3,600. Its market cap now stands at over $351 billion, cementing its status as the second-largest cryptocurrency behind bitcoin.

But what’s driving this resurgence? For one, recent announcements of Ethereum upgrades, such as the Decun upgrade slated for March and the chatters of the ERC-404 token standard, have enhanced network activity and adoption.

Institutional adoption and development activity on Ethereum are accelerating as well. Its transparency, security, decentralized nature, and programmability make it appealing for Web3 and metaverse projects. Even major banks plan to utilize Ethereum’s infrastructure to build tokenized financial markets.

In summary, ETH possesses long-term utility that extends far beyond speculative investing. This comprehensive value proposition explains its outperformance. While risks remain in this volatile asset class, Ethereum appears well-positioned to become the next institutional darling in crypto.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.