Key Highlights

Ethereum bulls buy the dips at the low of $538.50 low

The biggest altcoin resumes upside momentum as price rises to $560

Ethereum (ETH) Current Statistics

The current price: $567.16

Market Capitalization: $64,648,471,067

Trading Volume: $15,067,006,909

Major supply zones: $280, $320, $360

Major demand zones: $160, $140, $100

Ethereum (ETH) Price Analysis December 9, 2020

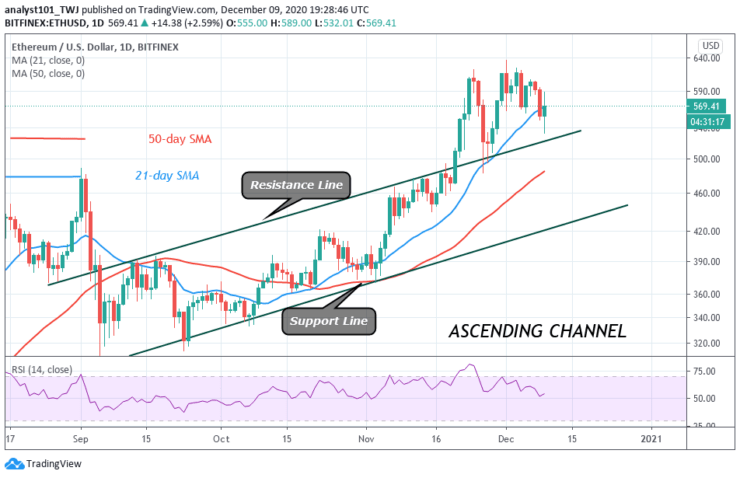

Yesterday, Ether faces resistance at the $620 resistance zone as the coin fell to $538 low. Immediately, the bulls buy the dips to push the altcoin to the previous highs. Today, Ethereum has risen to a high of $568 at the time of writing.

The upside momentum is likely to resume if the price is sustained above $560. The upside range is between $560 and $620 until a breakout is achieved. Meanwhile, the upward move is facing resistance at the $580 and $590. The candlesticks are displaying long wicks. These long wicks indicate that there is strong buying pressure at a higher price level.

ETH Technical Indicators Reading

The altcoin is at level 54 of the Relative Strength index period 14. It indicates that the coin is in the uptrend zone and above the centerline 50. The price bars are above the SMAs which indicates a further upward move.

Conclusion

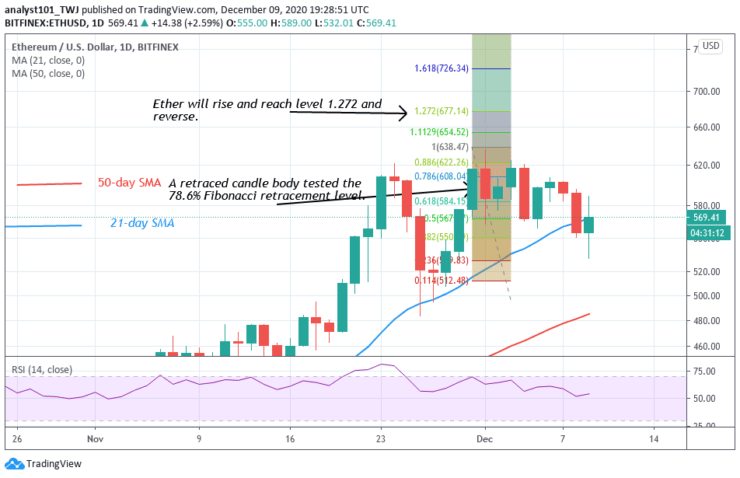

According to the Fibonacci tool, Ethereum is likely to move up but the uptrend will be shortlived. On November 30 uptrend; a retraced candle body tested the 78.6 % Fibonacci retracement level. This indicates that the Ether will rise and reverse at level 1.272 Fibonacci extension. That is the altcoin will reverse at $677.17.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.