Major demand zones: $160, $140, $100

ETH/USD Long Term Bias : Ranging

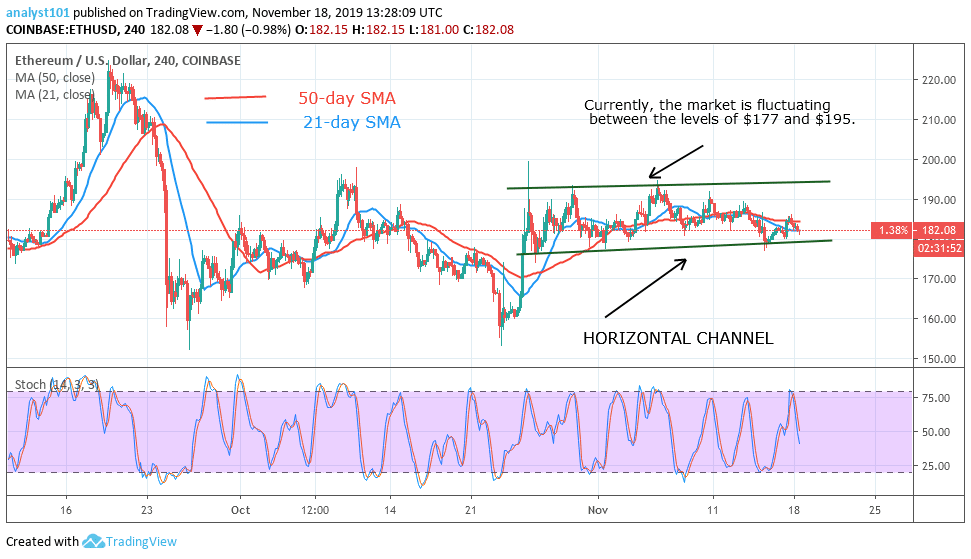

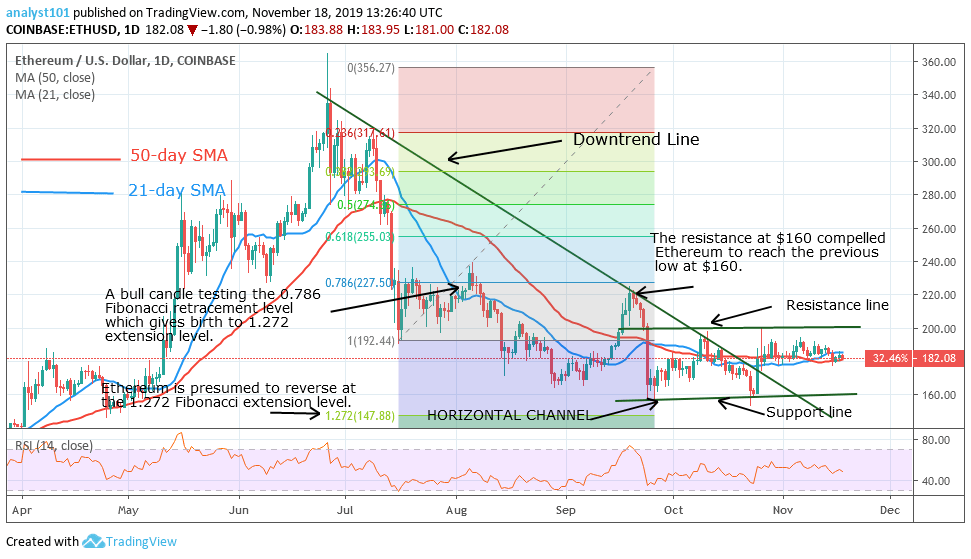

The ETH/USD pair had been in a range-bound move after the last bearish impulse in August. In the first instance, the price made an upward correction which was resisted at the $220. Consequent to that, the coin nosedived to the previous low at $160. Presently, the coin is fluctuating between the levels of $160 and $200. Recently, in October after the bulls took control of the price, the coin is now consolidating between the levels of $177 and $195.

Every time the market tests the $195 resistance, the coin will retrace to a low at $177. This has been the price situation in recent times. Nonetheless, if the price breaks the $200 price level, ETH will rally to $220. Also, if the upward move is sustained above $220, Ethereum will recommence its uptrend movement. ETH will be regarded as out of the range-bound zone. Meanwhile, the fluctuations will continue as long the coin is within the current price range.

Daily Chart Indicators Reading:

Ethereum has been reversed in September according to the 1.272 Fibonacci extension level. A break at the resistance line will compel ETH to resume a bullish movement.

ETH/USD Medium-Term Bias: Ranging

On the 4-hour chart, Ethereum is fluctuating between the levels of $177 and $195. The breaking of the levels will determine Ethereum’s next move. Meanwhile, the price is trading above the support line. This means the coin will fluctuate for a few more days.

4-hour Chart Indicators Reading

The 21-day SMA and the 50-day SMA are sloping smoothly in between the price level indicating the sideways movement. The market is in a bearish momentum below the 75% range of the Stochastic.

General Outlook for ETH

Ethereum is likely to continue to trade in a sideways move as the price is at $180. ETH may revisit the previous low if the bears have the upper hand above the bulls. The market seems to be stagnant above $180 for the past three days. If the bulls take control of the price, ETH will retest the resistance line.

ETH Trade Signal

Instrument: ETHUSD

Order: Buy Limit

Entry price: $160

Stop: $150

Target: $197

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.