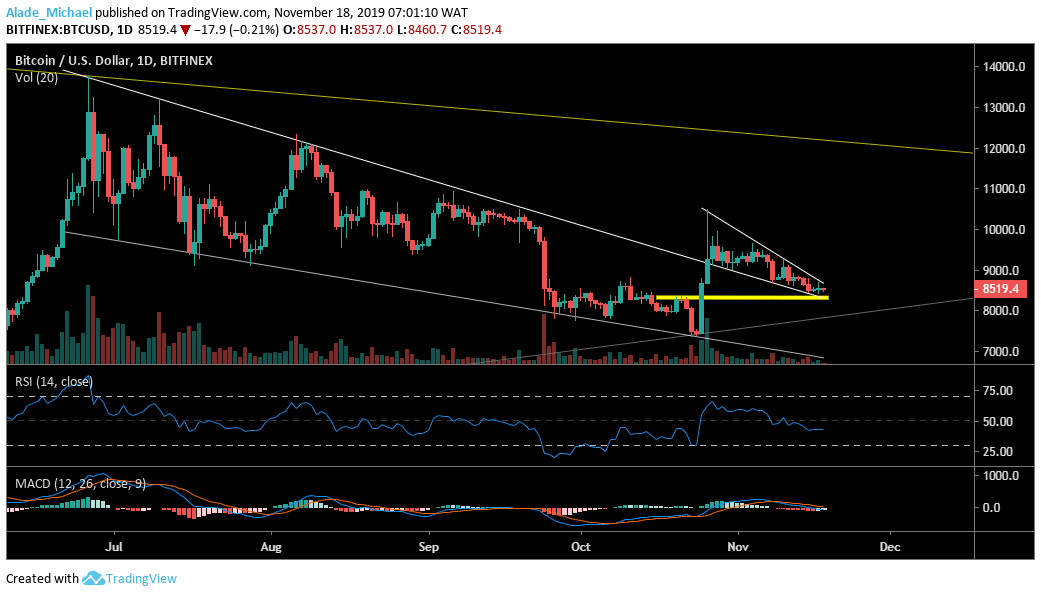

Bitcoin (BTC) Price Analysis: Daily Chart – Bearish

Key resistance levels: $8600, $8800, $9000,

Key support levels: $8300, $8200, $8100

Since Bitcoin broke out of the wedge in late October, the price has substantially decreased due to the selling pressure in the market. For the past three days now, the price of BTC has been trading around the $8500, keeping sellers on hold for a while. Similarly, the sellers seem to be weak at the moment. If the bulls can act upon this, Bitcoin’s price could regain strength.

The nearest resistance to expect the price is $8800, followed by $9000 before we can see a nice growth. On the other hand, a drive beneath the $8400 may allow bearish extension to $8250 and $8100 support. Now, the RSI is well below the 50 levels to reveal that Bitcoin is losing strength, although the MACD is sustaining bulls’ hope as it stays positive.

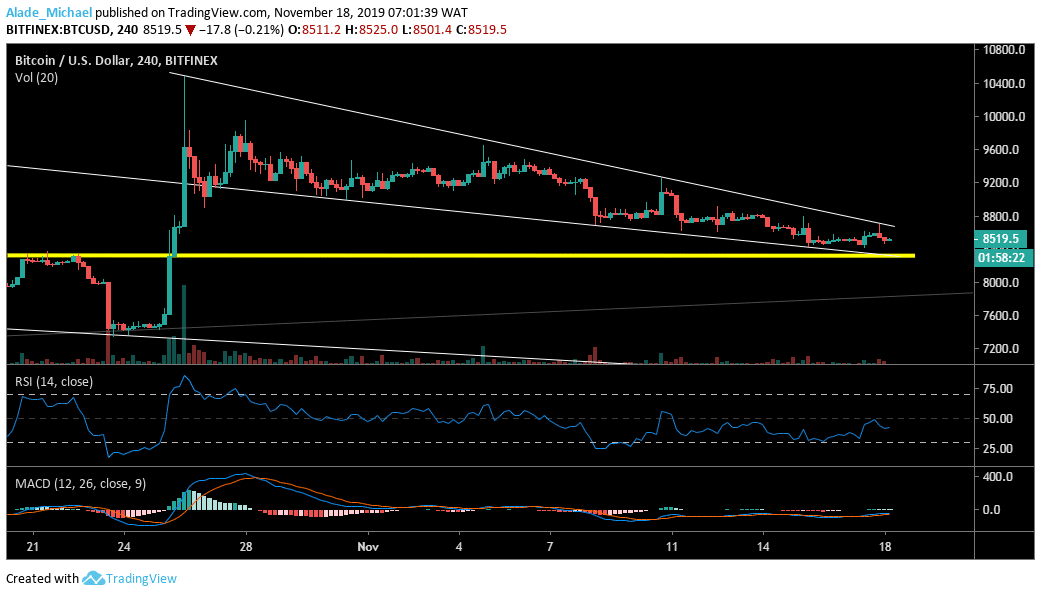

Bitcoin (BTC) Price Analysis: 4H Chart – Bearish

Bitcoin’s volatility is subdued with choppy price actions on the 4-hour chart. The market is now trading in a tight area which suggests a potential surge lurking around the corner. Taking a look at the RSI indicator, we can see that Bitcoin has been supported by the RSI 30 level since November 8.

If the RSI can continue to bolster, we can expect a bullish move to $8600, $8800 and $9000 resistance. But on the MACD, Bitcoin is still looking negative. Should $8400 support breaks, BTC may drop beneath the yellow horizontal support at $8300, $8200 and $8100. As of now, Bitcoin appeared fragile as big shock-wave is around the corner.

BITCOIN SELL SIGNAL

Sell Entry: $8507

TP: $8356

SL: 8657

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.