Price Analysis – December 11

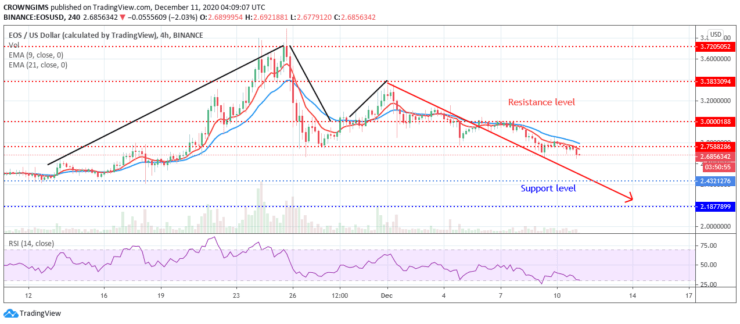

Further increase in the bears’ pressure will decrease the price to the $2.4 support level; the bearish momentum may extend to $2.1 and $1.5 if $2.4 does not hold the price. However, the resistance levels above the current price can found at $2.7, $3.0, and $3.3.

Key Levels:

Resistance levels: $2.7, $3.0, $3.3

Support levels: $2.4, $2.1, $1.5

EOS/USD Long-term Trend: Bearish

EOSUSD is bearish in the long term outlook. The crypto plays along the way it was predicted last week; the bears increase their momentum and the $3.0 level was penetrated downside. The bearish momentum was extended to $2.7, the just mentioned level could not hold the price, it was penetrated and currently exposed to the support level at $2.4. Further price declination is envisaged.

The coin is declining towards the support level of $2.4; the two EMAs have been penetrated downside and the coin is trading below the 9 periods EMA and 21 periods EMA. Further increase in the bears’ pressure will decrease the price to the $2.4 support level; the bearish momentum may extend to $2.1 and $1.5 if $2.4 does not hold the price. However, the resistance levels above the current price can found at $2.7, $3.0, and $3.3.

EOS/USD Price Medium-term Trend: Bearish

In the medium term, the EOSUSD is on the bearish trend. After the price retracement that took place on December 01 to the resistance level of $3.3, the bears resumed into the EOS market with increased pressure and the price started declination. The support level of $3.0 and $2.7 has been penetrated downside. The price is heading towards the $2.4 price level.

The 9-day EMA has crossed the 21-day EMA downward with the price below the 9-day EMA, confirming the downtrend. Should EOS price go down to the support level at $2.4 and refuse to produce a bearish candle pattern, then further downward movement may not be possible.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.