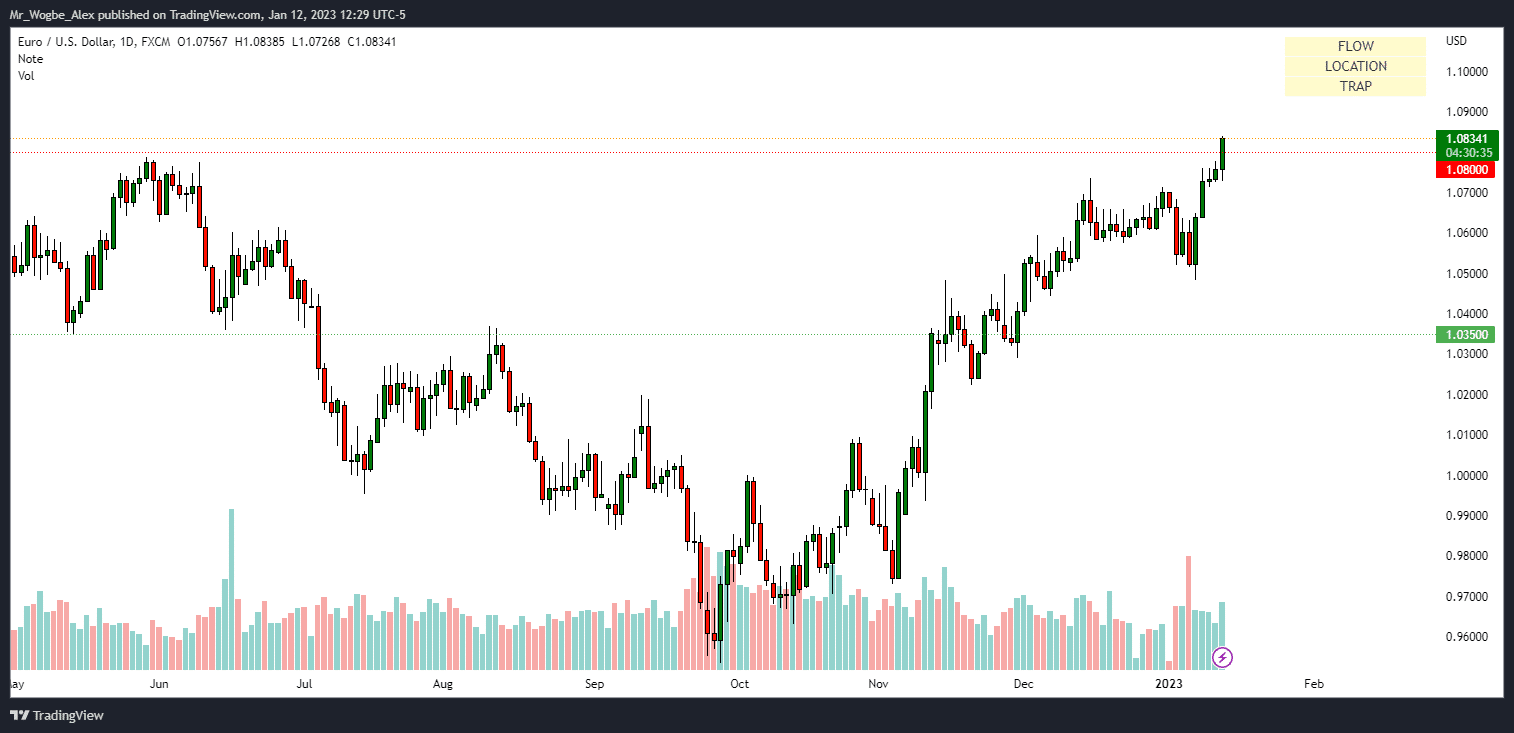

On Thursday, the EUR/USD currency pair saw an acceleration in its upside, reaching levels last seen in late April 2022, above the 1.0830 mark. This increase is due to a combination of factors, including increased selling pressure on the dollar, which was particularly exacerbated following the release of US inflation figures for December.

The US Consumer Price Index (CPI) rose to an annualized 6.5% in December, and the core CPI, which excludes food and energy costs, rose to 5.7% YoY. This retreat in headline consumer prices marks the sixth consecutive month of decline and contributes to the growing perception that the Federal Reserve may soon pivot in its monetary policy.

Additional data releases in the US also contributed to the weakness in the dollar. Initial jobless claims rose 205K in the week of January 7, surpassing economists’ expectations. This, along with the CPI data, caused the probability of a 25 bps rate hike at the next Federal Reserve event to climb to 82%, according to the CME Group’s FedWatch Tool.

Dollar Price Action Driving EUR/USD Dynamics

The price action of the EUR/USD is closely following the dynamics of the dollar, as well as the impact of the energy crisis on the region and the divergence in monetary policy between the Federal Reserve and the European Central Bank (ECB). Additionally, there is increasing speculation about a potential recession in the Eurozone, which could emerge as an important headwind for the European currency in the short term.

Finally, investors should keep an eye on key events in the Eurozone, such as France’s final inflation rate, Germany’s full-year GDP growth, and the EU’s balance of trade and industrial production, which will be released tomorrow.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.