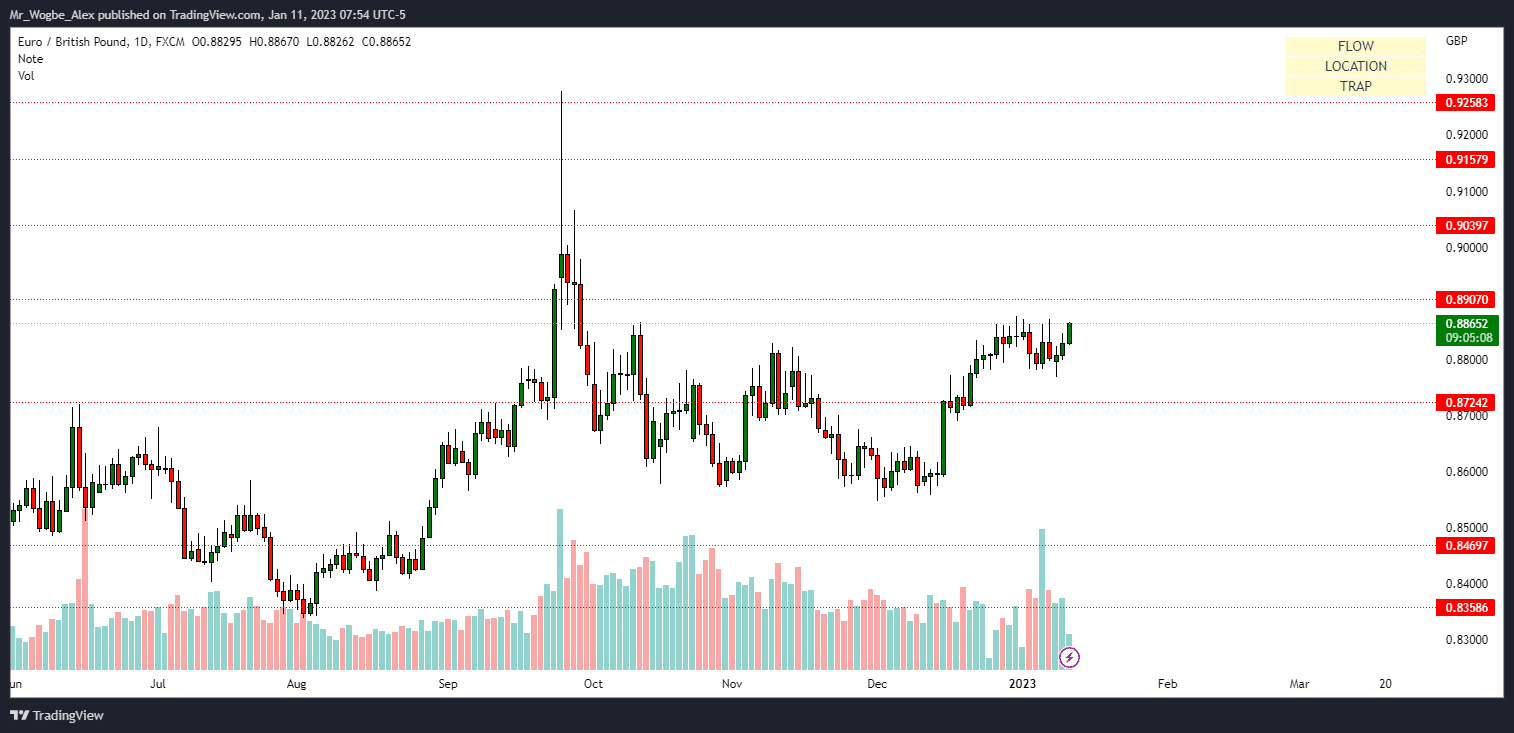

With the European Central Bank (ECB) resuming operations yesterday, the euro (EUR) extended its gains against the British pound (GBP) from yesterday. One of the more outspoken officials, Isabel Schnabel, bolstered the hawkish narrative, while the ECB’s Villeroy stated that future interest rate increases are required for his remarks today.

Money markets are currently pricing in two 50-bps rate hikes in February and March. The Bank of England (BoE), on the other hand, is anticipated to proceed a little more slowly given that they started their cycle of rate hikes far earlier than the ECB. Nevertheless, greater relative rate increases may encourage euro strength over the coming months.

When it comes to energy, both the UK and the eurozone have benefited from lowering oil and gas prices, but as sanctions and price controls on Russia get more severe, a response from that country could result in energy prices rising once more.

The UK and eurozone areas’ economic calendars are relatively light today and tomorrow, but the US CPI report is scheduled for tomorrow and could provide some support for the euro if inflation continues to decrease. Some significant UK and eurozone data will be released on Friday, including eurozone industrial production and UK and German GDP.

Goldman Sachs Adjusts GDP Prediction for Eurozone; Euro Could Benefit

In other related news, after the economy proved to be more resilient at the end of 2022, natural gas prices dropped precipitously, and China abandoned COVID-19 limitations sooner than expected; Goldman Sachs economists no longer forecast a recession in the eurozone.

In contrast to an initial prediction for a 0.1% decrease, this year’s gross domestic product is now anticipated to rise by 0.6%, according to the financial institution. In a note to clients, economists led by Jari Stehn forewarn of weak growth throughout the winter due to the energy crisis and predict that headline inflation will decline more quickly than anticipated, to roughly 3.25% by the end of 2023. A stronger economic outlook for the eurozone could help bolster the euro even further against the pound and other major counterparts.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.