The US dollar’s recent surge, triggered by persistent price pressures revealed in US inflation data last week, seems to be losing steam, despite the robust fundamentals underpinning the American economy. The dollar index (DXY) has largely traded sideways against a basket of major currencies since its spike on October 12. This phenomenon has left market observers wondering whether the dollar’s reign is approaching a peak.

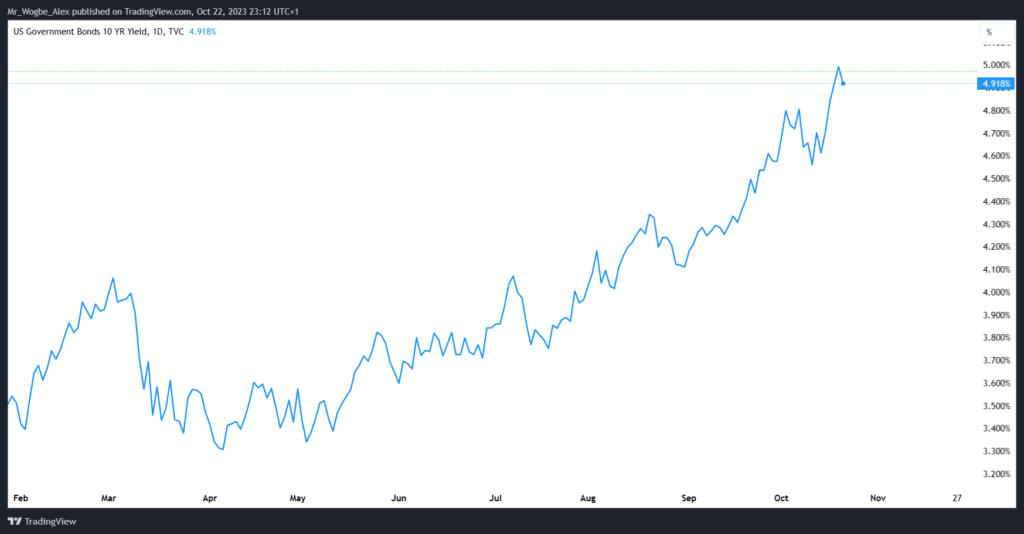

A significant factor driving the dollar’s trajectory is the US 10-year yield, which recently hit a remarkable 5%, the highest level since July 2007. This high yield reflects the hawkish stance of the Federal Reserve, which intends to further raise interest rates in the near future. However, the dollar has not mirrored this upward trajectory, hinting at a possible plateau.

Dollar Needs Strong Catalysts for Upward Momentum

To regain its upward momentum, the dollar may require a substantial catalyst. One such catalyst could be the release of US GDP data for the third quarter, scheduled for this Thursday. Expectations are for robust economic growth, despite tight financial conditions.

Several other factors are poised to influence the dollar in the coming days. The monetary policy decisions from the central banks of Canada and Europe are keenly awaited, as they could impact their respective currencies and, in turn, the DXY.

Moreover, the ongoing military conflict in Gaza may sway risk sentiment in the global markets, potentially impacting the safe-haven demand for the dollar.

Investors will also be keeping a close watch on third-quarter earnings reports from tech giants like Alphabet, Microsoft, Amazon, and Meta. These reports have the potential to shed light on the current and future business environment and consumer behavior, which, in turn, could sway the dollar.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.