The dollar continued its downward trend on Thursday, influenced by a flurry of economic reports presenting a mixed outlook for the U.S. economy, prompting speculation of potential interest rate cuts by the Federal Reserve.

The U.S. dollar index, gauging the currency against a basket of six major counterparts, slid by 0.26% to 104.44.

Concurrently, the dollar depreciated by 0.5% against the yen, settling at 150 amid apprehensions regarding potential Japanese intervention to counter the yen’s upward trajectory.

Japan Goes Into Technical Recession

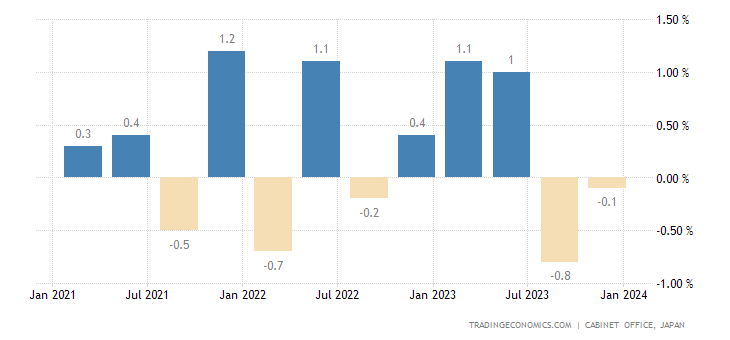

Remarkably, despite Japan’s disappointing GDP figures revealing a 0.1% contraction in the fourth quarter of 2023, plunging the nation into a technical recession and trailing behind Germany globally, the yen strengthened.

On the flip side, although the U.S. economy demonstrated signs of resilience, the Federal Reserve appears inclined towards easing its monetary policy. January witnessed a 0.8% decline in retail sales, surpassing the anticipated 0.1% dip, largely attributed to the disruptive effects of winter storms.

Conversely, unemployment claims saw a decline from 8,000 to 212,000, indicating a tight labor market.

Nevertheless, the industrial sector exhibited signs of sluggishness, with a 0.1% downturn in production, reaching its lowest since October. Manufacturing activities in regions like New York and Philadelphia, while showing modest improvement in February, lingered in negative territory.

The contrasting economic indicators have strengthened the belief that the Federal Reserve might initiate rate cuts as early as June, given subdued inflation and a deceleration in global growth.

Dollar Losses Across Board on Thursday

Despite relatively positive U.S. indicators, the dollar faced setbacks. Against the Swiss franc, it depreciated by 0.57%, landing at 0.8806 francs. Concurrently, the euro experienced a 0.32% uptick to $1.0760, while sterling climbed by 0.13% to $1.2582.

The dollar’s weakness presents opportunities for forex traders seeking to capitalize on currency fluctuations. For those interested in delving deeper into forex trading, our premium forex signals service offers access to expert analysis, tips, and strategies.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.