The US dollar exhibited resilience in the wake of a turbulent week, with market sentiments swaying in response to hints of further rate hikes by Federal Reserve officials. Investors eagerly awaited Federal Reserve Chair Jerome Powell’s upcoming speech, seeking clarity on the central bank’s policy direction.

After a sharp decline following the Fed’s decision to maintain its policy rate and disappointing US labor market data, the dollar rebounded as market participants remained divided over whether the Fed had reached the pinnacle of its rate cycle and the timing of potential monetary easing.

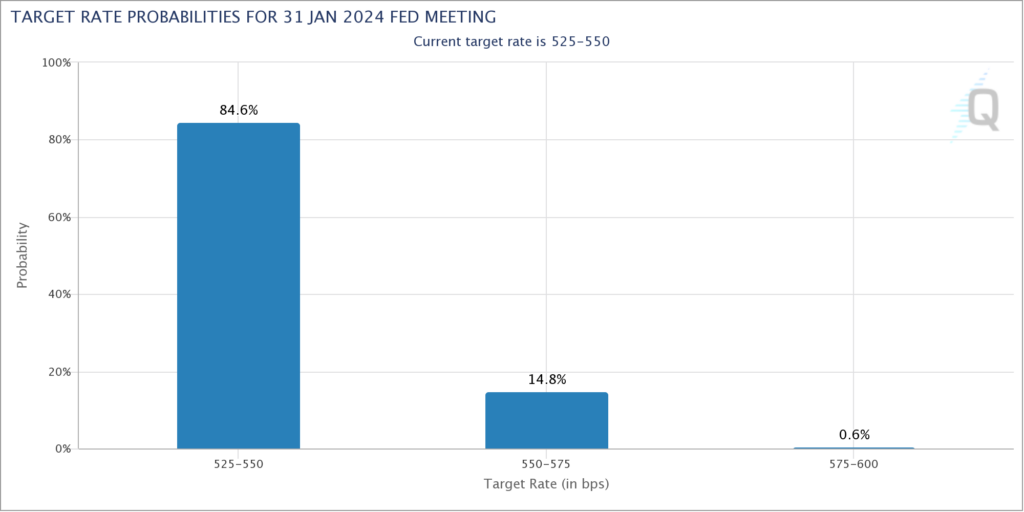

According to the CME FedWatch tool, futures indicated a low probability of another rate hike by January, but the possibility of a rate cut by March gained traction.

Dollar Gains Across Board

The dollar index, gauging the greenback against six major currencies, posted a 0.24% increase, reaching 105.75 and heading for a weekly gain.

Conversely, the euro dipped 0.24% to $1.0674, hampered by a bleak growth outlook in the eurozone, exacerbated by disappointing German industrial production data for September.

The British pound also experienced a 0.29% decline, settling at $1.2263, retreating from its earlier seven-week high above $1.24.

The Japanese yen maintained its soft stance, trading at 150.65 per dollar, despite a brief strengthening spell the previous week.

The Australian dollar remained steady at $0.6440 after a 0.8% drop on Tuesday, its most substantial daily decline in about a month. The Reserve Bank of Australia (RBA) had elevated interest rates to a 12-year high but tempered its tightening bias, linking it more closely to incoming data.

Similarly, the New Zealand dollar traded flat at $0.5936, recording a modest 0.05% increase.

The US dollar’s resurgence reflects the ongoing uncertainty surrounding the Federal Reserve’s rate trajectory, making it a key focus for investors and economists alike. Powell’s upcoming speech may offer much-needed clarity and potentially reshape market dynamics in the coming days.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.