EURUSD Price Analysis – May 4

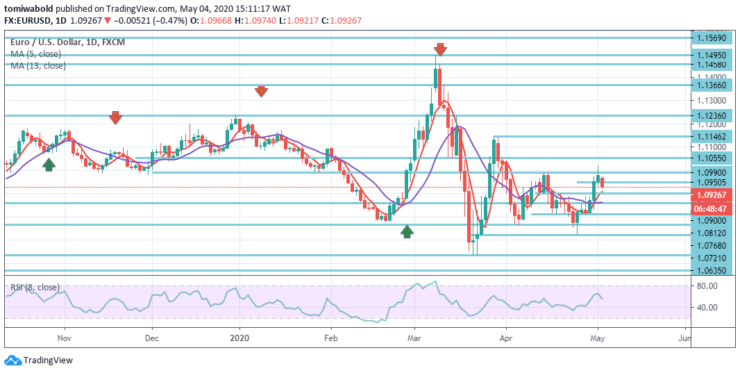

At the weekly start, the EURUSD pair pulled back lower, as the market jump-started in the risk-off mood on Monday. After the Asian session, the pair’s slump was apparent, though the pair gained little support near 1.0930 level amid London trading hours, while bottoming at 1.0922 level. European data was balanced, but dismal as market sentiment stays poor.

Key Levels

Resistance Levels: 1.1495, 1.1146, 1.0990

Support Levels: 1.0860, 1.0768, 1.0635

EURUSD Long term Trend: Ranging

On Friday, EURUSD’s proper rebound attempted to momentarily exceed the key 1.10 hurdle, having lost some traction shortly thereafter. A breach of this initial area of resistance in the mid-1.1100s may pave the way to a likely return to the highs of late March.

On the contrary, a breach of 1.0900 level may shift bias back to the downside for support level 1.0812 and then low level 1.0635. In much the same instance, only when the 1.1055 range is removed in a balanced way the downside risk is likely to further reduce.

EURUSD Short term Trend: Ranging

The EURUSD pair’s 4-hour chart shows that it leaped upward from around a bullish moving average of 5 and 13, which has also crossed downward. The 5 and 13 moving average converges on its confluence zone at about 1.0860 level, offering variable support.

Meanwhile, technical indicators continue within positive levels but have lost their directional force. As a whole, the downside appears restricted as long as the pair is above the specified level of 1.0860. Intraday bias in EURUSD is rendered neutral, with RSI sitting around the 50 signal line over 4 hours.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.