USDWTI Price Analysis – May 4

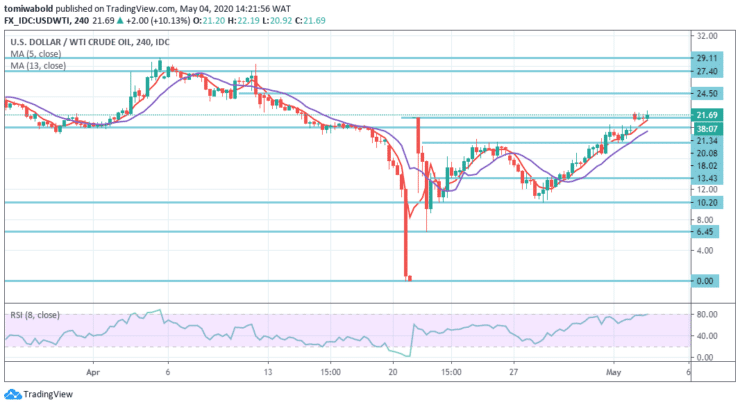

The current forward term is rising to USDWTI’s level of $27.40 after bouncing off lows for June WTI, this week with the shift in movement path reinforces market centered on the demand transition level; seeking to slowly remove transportation constraints in major economies.

Key Levels

Resistance Levels: $29.11, $27.40, $24.50

Support Levels: $21.32, $18.02, $13.43

USDWTI Long term Trend: Bearish

Oil prices registered a notable recovery. WTI crude oil posted moderate progress during Friday’s market activity, rising beyond the $18.02 mark. Which defines the double bottom pattern close to the price of $10.20 level.

So well as prices stay beyond the level of $18.02 we foresee higher oil prices to tend to swing. Another target is on a bullish follow-through at $27.40 level. However, prepare for a probable bullish gap in case crude oil reverts back beneath the level of $18.02 whenever it grapples with support.

USDWTI Short term Trend: Ranging

Despite breaking a short-term horizontal threshold at a level of $21.34, WTI is heading for April 9 moving average 5 and 13 crossing downturn, near $24.50 level in the near term, ahead of aiming at $27.40 level in upper horizontal resistance range.

In the meantime, a horizontal line of support around $20.08 level seems to deliver the turnaround maneuvers of the oil benchmark over the horizontal resistance-turned-support line, presently about $21.34 level. This being said, in the short-term perspective, the $24.50 mark stays on the radar, declining active demand and volume leaves something more upside down.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.