DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade- June 14

DeFI Coin Price forecast calls for new highs as the correction phase reaches demand levels.

DEFCUSD Long-Term Trend: Bullish (1 hour chart)

DEFCUSD significant Levels:

supply zones: $0.5640, $0.4950

Demand zones: $0.1530, $0.9660

DEFCUSD coin shot up in the market price on the 4th of May. The market was oversold on the Stochastic indicator before the shoot-up of DEFCUSD. The bears attempted to drive the market low at $0.4840 but failed. The price eventually rose to the supply level at $0.5640. The surge in the price of DEFC lasted for two days.

DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: Market Outlook

DeFI Coin market faced resistance at $0.5640, which resulted in the retracement of DeFi. The retracement was initiated after the bullish impulse. The Stochastic indicator signified that the market was ready for a sell-off, resulting in a shift in market structure at the $0.5640 resistance level.

The market crashed below the supply zone at $0.4840. A purge in the price was caused by the retest of the key zone at $0.4840. The market moved sideways between the supply zone at $0.4840 and the demand zone at $0.1530.

The market’s volatility reduced significantly as the market’s correction phase was initiated. The market is currently in a good area to buy, below the $.0.786 level on the Fibonacci. The buyers can utilize the demand level to go purchase DEFC coins.

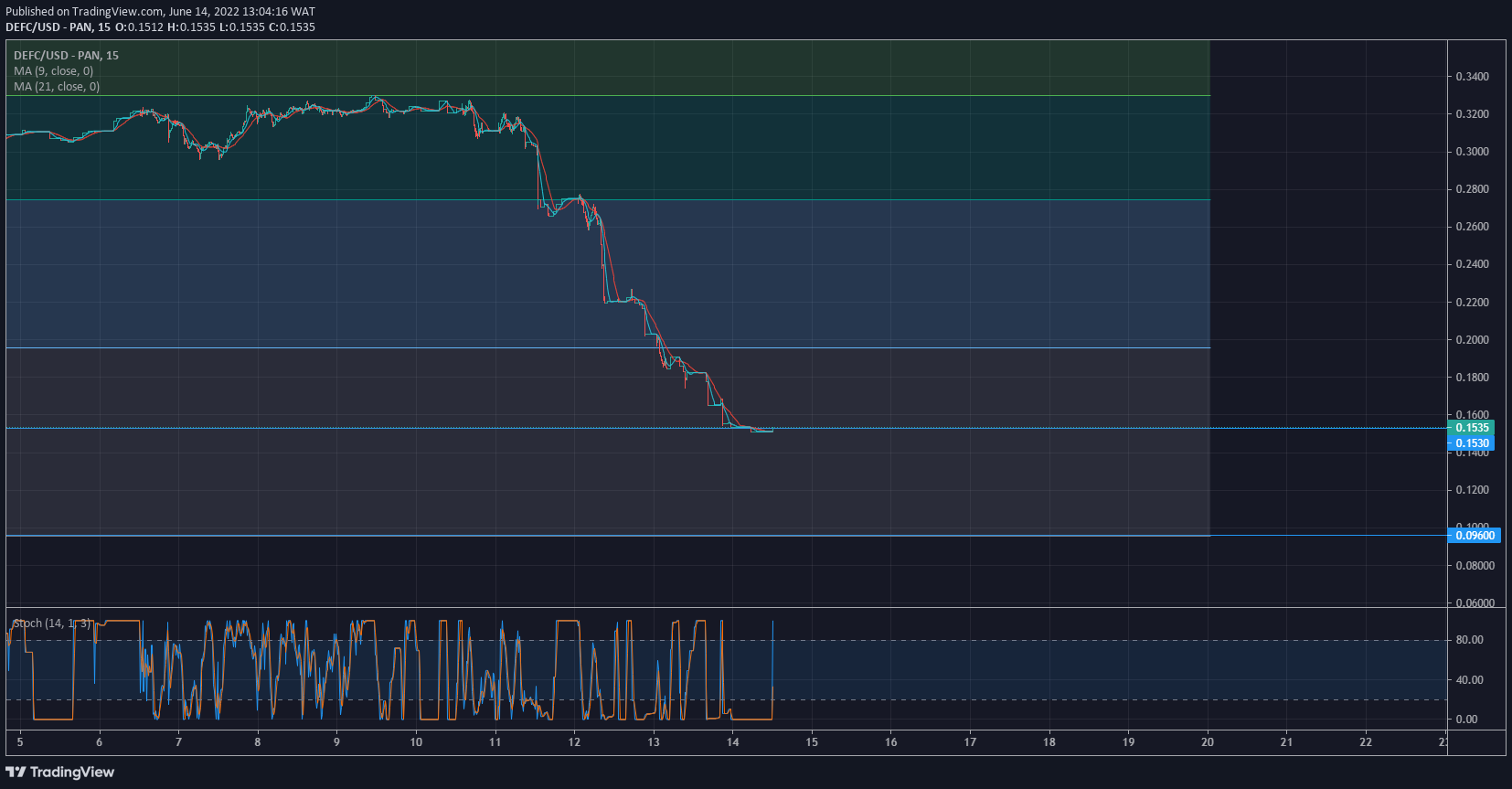

DEFC Medium-Term: Trend Bullish (15 minute chart).

The price has dropped to a very close range around the $0.1530 demand level. The support zone is far enough from the premium price for the bulls to be active.

You can purchase DeFi Coin here: Buy DEFC

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.