DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – May 30

The DeFI Coin price forecast is bullish. The bullish trend line has provided an opportunity for the bulls to ascend in the market.

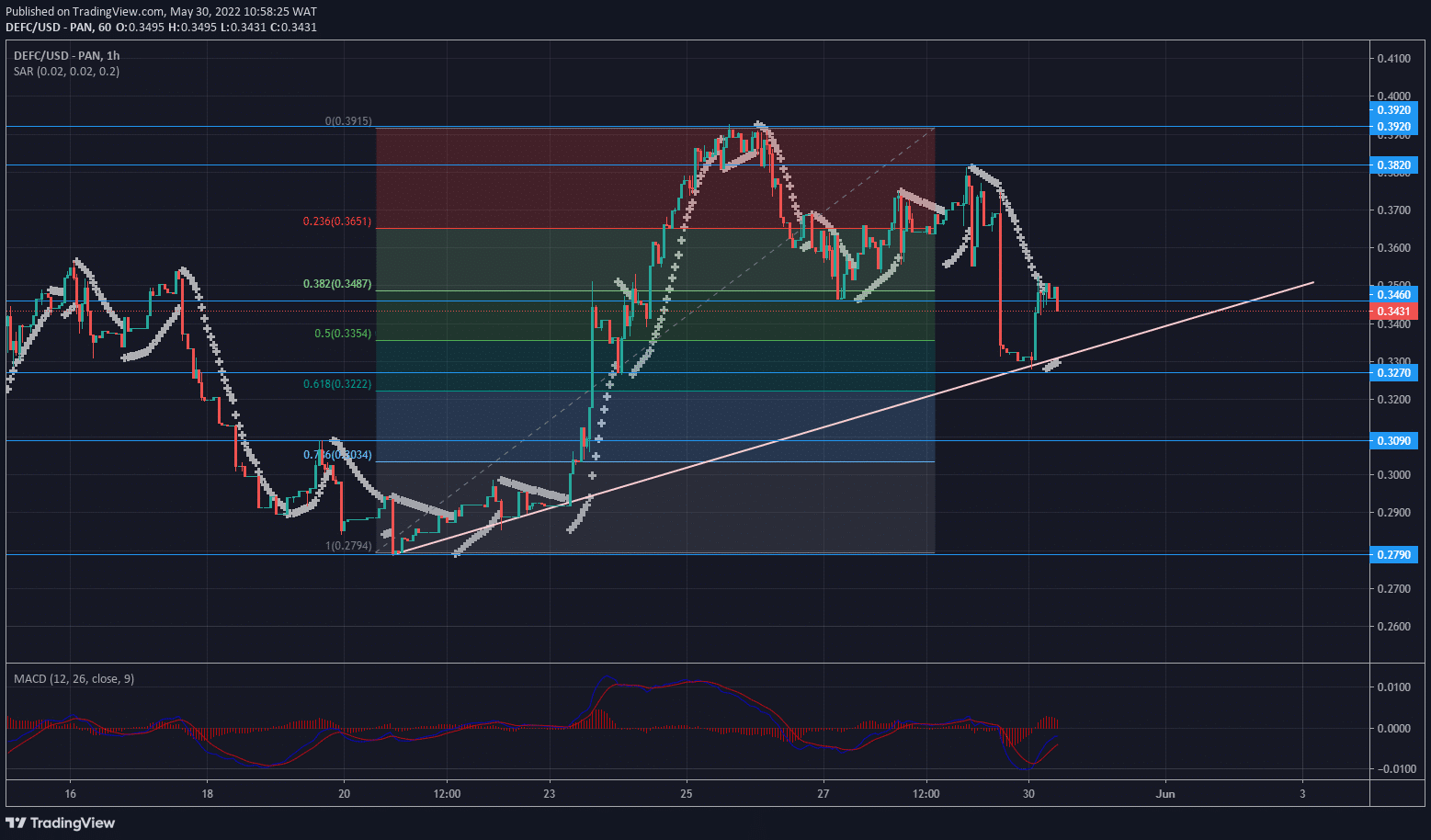

DEFCUSD Long-Term Trend: Bullish (1 hour chart)

DEFCUSD Key Levels:

Supply Zones: $0.3920, $0.3820, $0.3090

Demand Zones: $0.2790, $0.3090, $0.3270

DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: Market Outlook

The consolidation at $0.2790 revealed the tussle between the bulls and the bears. The Parabolic SAR (Stop and Reverse) formed points above and below the candles at the support level. The points formed last below the consolidation were signs that the bulls eventually pulled through.

The market broke the resistance at $0.3090 and shot up afterwards. The market rose to $0.3920, where it met resistance. The MACD (Moving Average Convergence Divergence) signified the market was oversold. The market changed direction to seek support.

The DEFC coin has retraced 50% of its swing at equilibrium. The bullish trend line has also provided support to continue the overall bullish move.

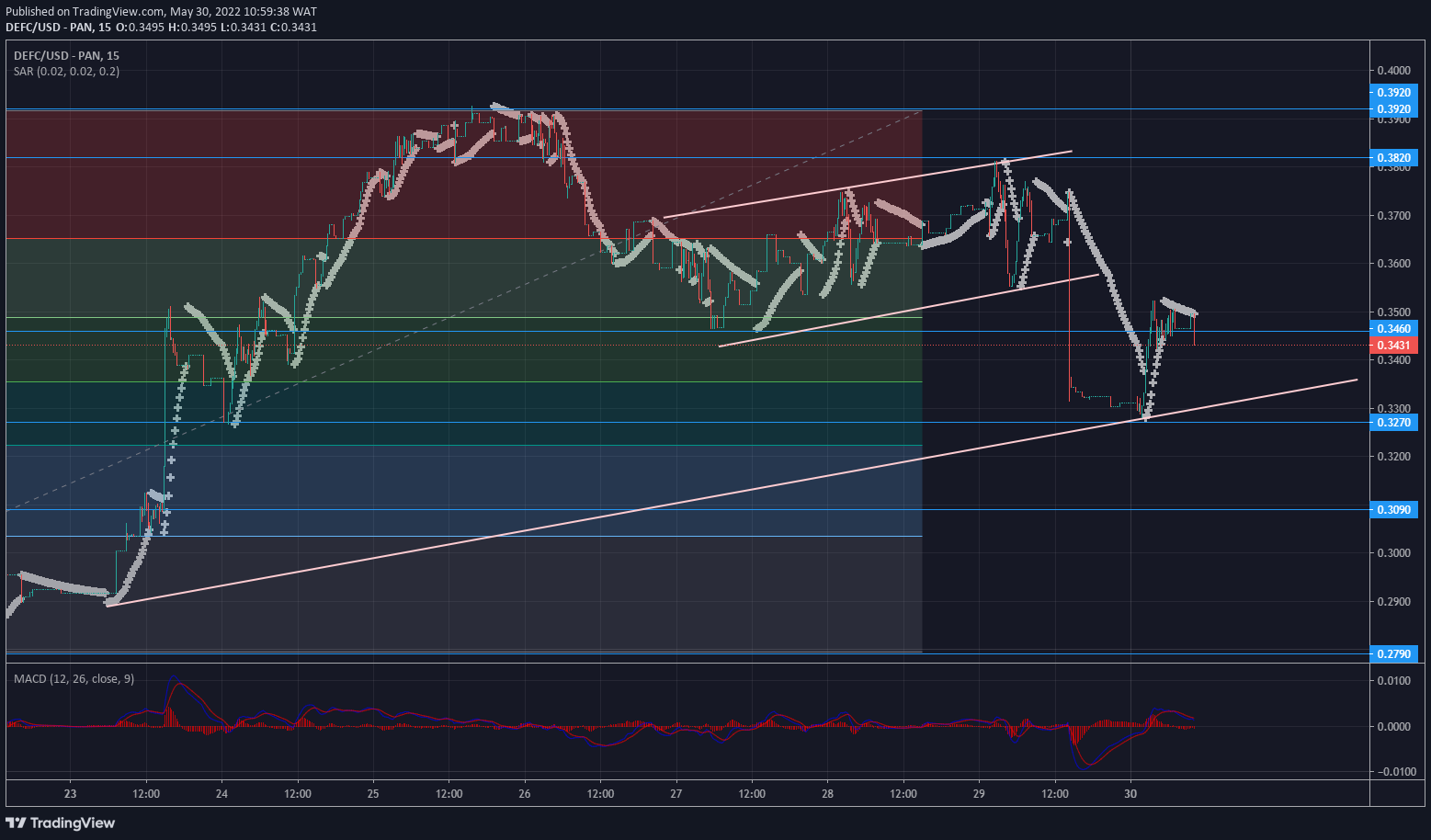

DEFC Medium-Term: Trend Bullish (15-minute chart)

The 5-minute chart shows a breakout in the lower timeframe from the ascending channel. The 5 minute time frame shows the bullish confluence of the ascended trend line and the major zone at $0.3270.

You can purchase DeFi Coin here: Buy DEFC

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.