DeFI Coin Price Anticipation – July 25

The DeFI Coin price anticipation is for the market to keep rising towards the borderline of its ascending channel. There is an anticipation of confrontation at the borderline, but bulls can be expected to edge through.

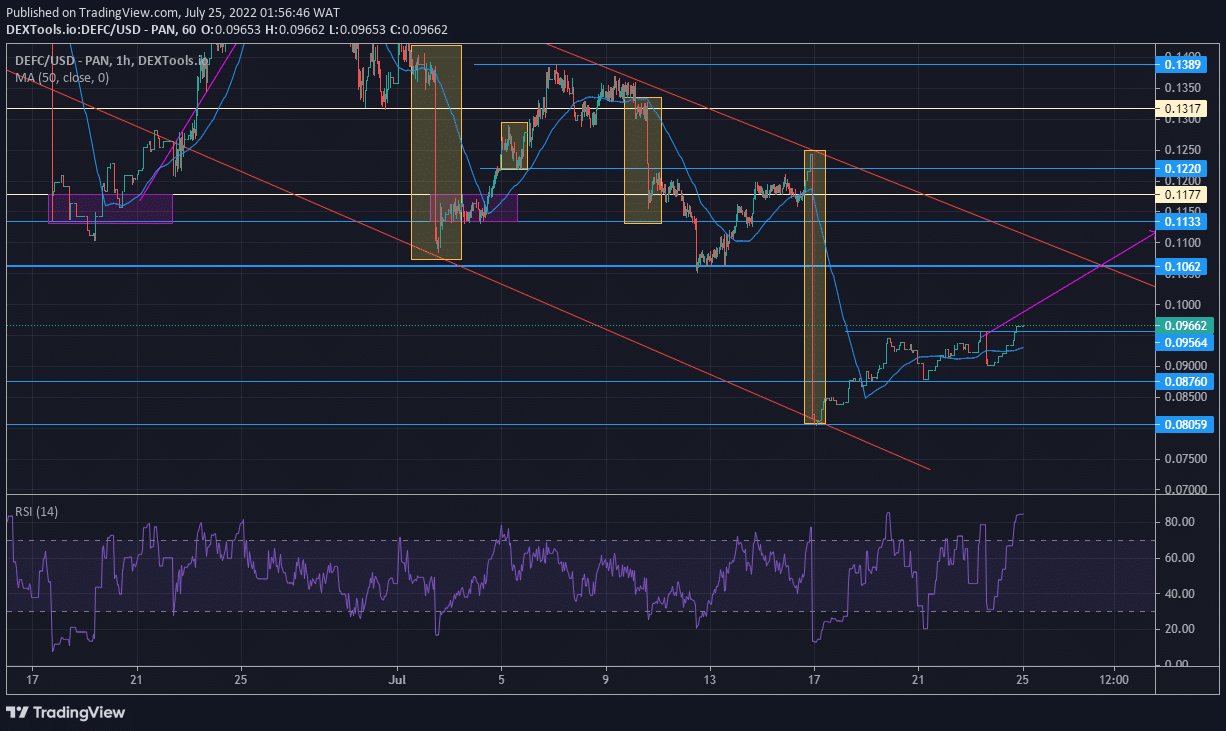

DEFCUSD Long-Term Trend: Bullish (1-hour Chart)

Key Levels:

Supply Zones: $0.106200, $0.113300, $0.122000

Demand Zones: $0.080590, $0.087600, $0.095640

DeFI Coin Price Forecast – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade – Expert Analysis & Trading Tips | Learn 2 Trade: DEFCUSD Market Prospects

The sellers have seemingly set their guard at the borderline of the descending channel, so there is always a strong dip in the market whenever the price rises to this level. However, the buyers are determined to break this jinx.

Therefore, DeFI Coin has immediately set about reaching back upwards immediately after it dropped to $0.08059. The immediate resistance at the $08760 significant level has been conquered. The coin is now seemingly accumulating below $0.09564 to gather momentum to shoot up.

$0.10620 is most likely the level for a clash of strengths. The bulls have the advantage of storing momentum at this time, and the RSI (Relative Strength Index) already indicates an overbought market. DeFI might pull back once more before unleashing at the channel’s upper borderline.

DEFCUSD Medium-Term Trend: Bullish (15-Minute Chart)

The 15-minute chart also shows that the coin’s movement has been majorly around the centerline of the Relative Strength Index Indicator. However, like the 1-hr chart, the price has risen into overbought territory. This is even though the market itself is moving in a sideways trend.

You can purchase DeFi Coin here: Buy DEFC

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.