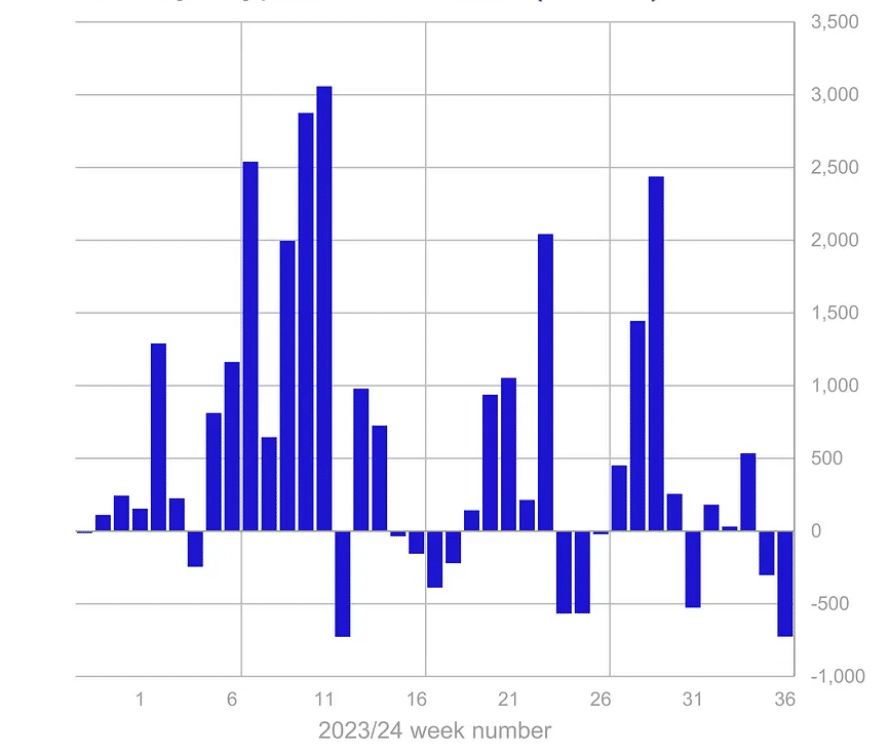

In a significant market development, digital asset investment products have recorded substantial crypto outflows totaling $726 million over the past week, according to the latest CoinShares report. This figure matches the largest recorded outflow set in March of this year, indicating a notable shift in investor sentiment.

Bitcoin (BTC), the leading cryptocurrency by market capitalization, bore the brunt of these outflows, with $643 million exiting BTC-related investment products. Ethereum (ETH) followed with outflows of $98 million, primarily from the Grayscale Ethereum Trust.

James Butterfill, Head of Research at CoinShares, stated,

“We believe this negative sentiment was driven by stronger-than-expected macroeconomic data from the previous week, which increased the likelihood of a 25 basis point interest rate cut by the U.S. Federal Reserve.”

Crypto Outflows: Analysis

The outflows were heavily concentrated in the United States, which saw $721 million leave the market. Canada also experienced outflows of $28 million. In contrast, European markets showed resilience, with Germany and Switzerland recording inflows of $16.3 million and $3.2 million, respectively.

For asset-specific trends:

- Short-Bitcoin products saw minor inflows of $3.9 million, suggesting some investors are positioning for potential further price declines.

- Solana (SOL) bucked the overall trend, attracting the largest inflows of any asset at $6.2 million.

- Ethereum-based products experienced significant outflows, with newly issued ETFs seeing minimal inflows.

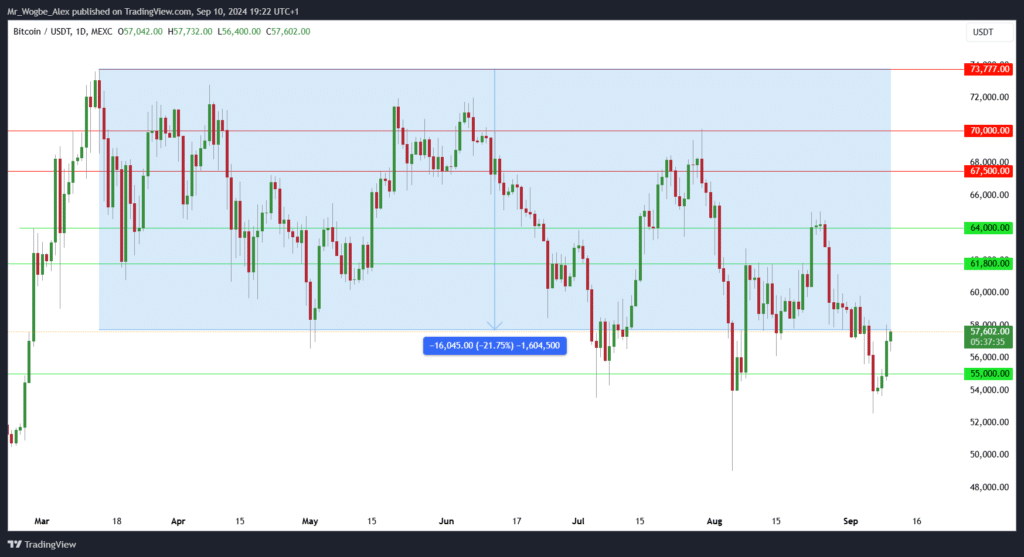

The substantial outflows have had a noticeable impact on cryptocurrency prices. Bitcoin’s value has declined by nearly 15% over the past two weeks, currently trading at $57,300, down over 21% from its March peak of $73,797.

Future Outlook

Market participants are closely monitoring several factors that could influence future trends, including:

- The upcoming Consumer Price Index (CPI) inflation report, which could impact Federal Reserve decisions on interest rates.

- The first debate between Donald Trump and Kamala Harris, though Polymarket traders give low probabilities (11% for Harris, 13% for Trump) of either candidate mentioning crypto or Bitcoin.

As the crypto market navigates this period of uncertainty, analysts emphasize the importance of monitoring fund flows, macroeconomic indicators, and regulatory developments in the coming weeks to gauge whether this outflow trend will continue or reverse.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.