The cryptocurrency market faced significant headwinds this week, with digital asset investment products experiencing substantial crypto outflows totaling $1.2 billion over three consecutive trading days.

This marks one of the most notable withdrawal periods in recent months, primarily triggered by the Federal Reserve’s hawkish stance during its latest FOMC meeting.

Understanding Recent Crypto Outflows

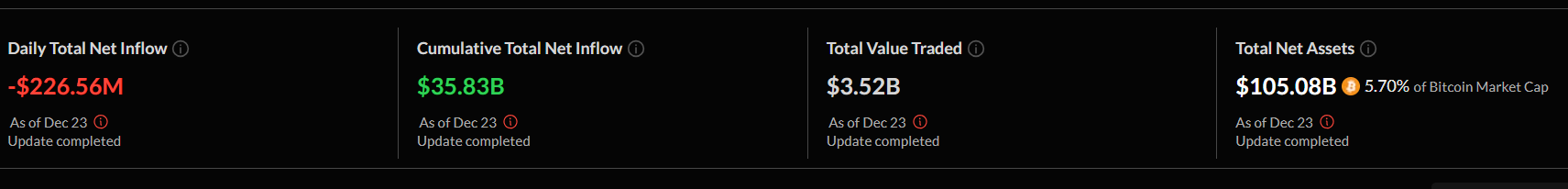

Bitcoin ETFs, which had previously enjoyed strong investor interest, bore the brunt of the selloff. The twelve U.S.-based spot Bitcoin ETFs saw their total value drop by $10.7 billion between December 18 and December 23, bringing the total assets under management to approximately $105 billion. This figure represents a sharp decline from the peak of $121.7 billion recorded on December 16.

Fidelity’s FBTC emerged as one of the hardest-hit funds, recording outflows exceeding $426 million during this period. However, not all providers faced equal pressure—BlackRock’s IBIT demonstrated relative resilience, limiting its outflows to just $41 million across the three-day span.

Investment Trends Across Digital Assets

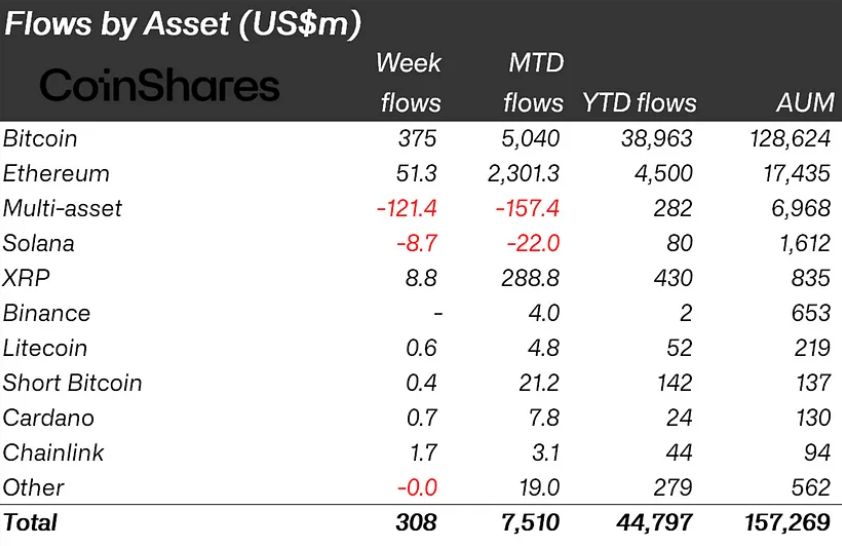

While Bitcoin products faced selling pressure, other cryptocurrencies showed varying performance. Ethereum continued attracting capital with inflows of $51 million, while XRP secured $8.8 million in new investments. Horizen and Polkadot also saw positive flows, gaining $4.8 million and $1.9 million, respectively. In contrast, Solana experienced outflows of $8.7 million.

Multi-asset investment products recorded the most dramatic shift, with outflows reaching $121 million. This suggests investors are moving away from diversified crypto exposure in favor of more targeted positions in specific digital assets.

Early signs of recovery emerged on Tuesday as Bitcoin’s price surged nearly 6% within 24 hours. Similarly, Ethereum’s value increased by 5%, indicating potential stabilization in the crypto market. These price movements highlight the growing sophistication of crypto investors, who are becoming more selective in their investment choices rather than taking broad exposure across the sector.

The current situation also underscores the increasing connection between traditional financial markets and cryptocurrency investments, as shown by the impact of the Federal Reserve’s monetary policy decisions on digital asset flows. As the market continues to mature, investors appear to be making more calculated decisions based on specific asset performance rather than treating cryptocurrencies as a single investment category.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.