Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin and Crypto Options Expiry Set to Drive Market Volatility

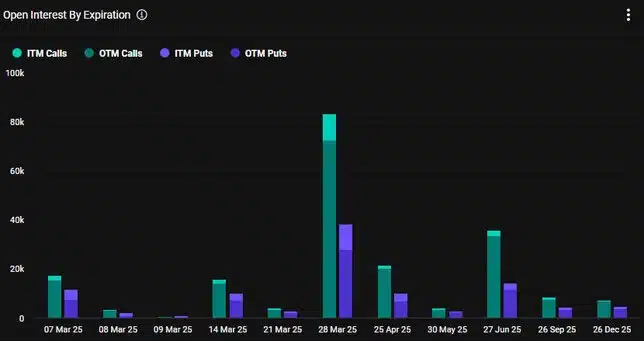

Crypto markets are bracing for turbulence as $3 billion in options contracts expire this Friday. Among these, around 29,000 Bitcoin options contracts hold a notional value of $2.5 billion. While this week’s event is smaller than last Friday’s month-end expiry, a much larger expiration is scheduled for March 28.

The Bitcoin options market currently shows a put/call ratio of 0.67, indicating more call (long) contracts than puts (shorts). Open interest remains significant, with $1.4 billion at the $120,000 strike price and over $1 billion at $100,000 and $110,000 levels. Meanwhile, bearish positions totaling $750 million are concentrated at $80,000 and $70,000.

Source: Deribit

Analysts suggest that traders are watching the $87,000–$89,000 range as key resistance, while $82,000 is considered a crucial support level. Debate continues over whether Bitcoin has reached a stable bottom.

Ethereum options are also expiring today, with 223,000 contracts valued at $482 million. Combined, today’s crypto options expiry amounts to approximately $3 billion, adding to market uncertainty.

Trump’s Bitcoin Reserve Move Sparks Crypto Market Sell-Off

Crypto markets reacted sharply following Donald Trump’s executive order establishing a Strategic Bitcoin Reserve. This announcement triggered a $200 billion drop in total crypto market capitalization, intensifying market volatility.

Bitcoin’s price tumbled nearly 6%, falling from above $90,000 to $85,000 in less than an hour before rebounding to $88,000. The sell-off was fueled by remarks from White House crypto czar David Sacks, who clarified that the reserve would be funded using Bitcoin already seized by the U.S. government. Many investors took this to mean no new BTC purchases, leading to panic selling.

However, the executive order also instructs Treasury and Commerce officials to explore “budget-neutral” strategies for acquiring additional Bitcoin. As a result, crypto traders remain cautious, closely monitoring market movements ahead of the next major expiry at the end of the month.

Make money without lifting your fingers: Start using a world-class auto trading solution.

EightCap, your trusted Partner in CFDs, Cryptocurrencies and Stocks.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.