Bitcoin continues its downward trend, hovering around $84,500 after briefly dipping towards $78,000 earlier today.

According to Standard Chartered’s global head of digital assets research, Geoffrey Kendrick, the cryptocurrency could fall further to between $69,000 and $76,500 by Monday (March 3)—a level he described to The Block as “a dip I would like to buy.”

This price drop comes during a significant market correction, with Bitcoin on track to close February with a 17% decline, potentially marking its second-worst February in history. Wednesday saw record outflows from IBIT, BlackRock’s spot Bitcoin ETF, totaling $418.1 million.

BlackRock’s Strategic Move Amid Market Volatility

Despite the current price weakness, BlackRock, the world’s largest asset manager, is adding its iShares Bitcoin Trust ETF (IBIT) to certain “model” portfolios marketed to financial advisors. According to Bloomberg, the company will include a 1% to 2% allocation to the $48 billion fund in its target allocation portfolios that allow for alternatives.

This development could eventually generate additional demand for IBIT, which remains the market leader among spot Bitcoin ETFs with over $48 billion in assets under management. Fidelity’s competing product ranks second with approximately $23 billion.

Understanding the Current Market Dynamics Around Bitcoin

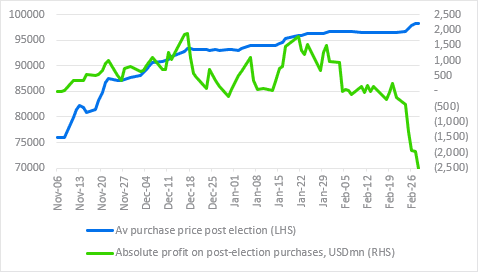

Kendrick points to several factors driving the current price action. Since the U.S. election last November, net ETF purchases have declined by $2.5 billion at the $80,000 price level.

While some analysts argue that ETF outflows reflect market-neutral activity from closing carry trades, Kendrick believes these trades aren’t substantial enough to explain recent redemptions.

Instead, he highlights increasing short positions from hedge funds as evidence that investors are actively betting against Bitcoin. CFTC data shows hedge fund short positions grew from $7.9 billion to $11.3 billion since the U.S. election (as of February 18).

ETF investors remain predominantly in long positions, potentially making them vulnerable to panic selling if prices continue dropping. Kendrick expects another large outflow from ETFs today, following Tuesday’s redemption of over $1 billion.

The analyst compares the current market setup to August 2024, when Bitcoin fell from $70,000 to $50,000 in a single week. If a similar pattern emerges, another 5.5% decline would place Bitcoin in the $69,000 to $76,500 range—precisely where Kendrick sees a buying opportunity.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.