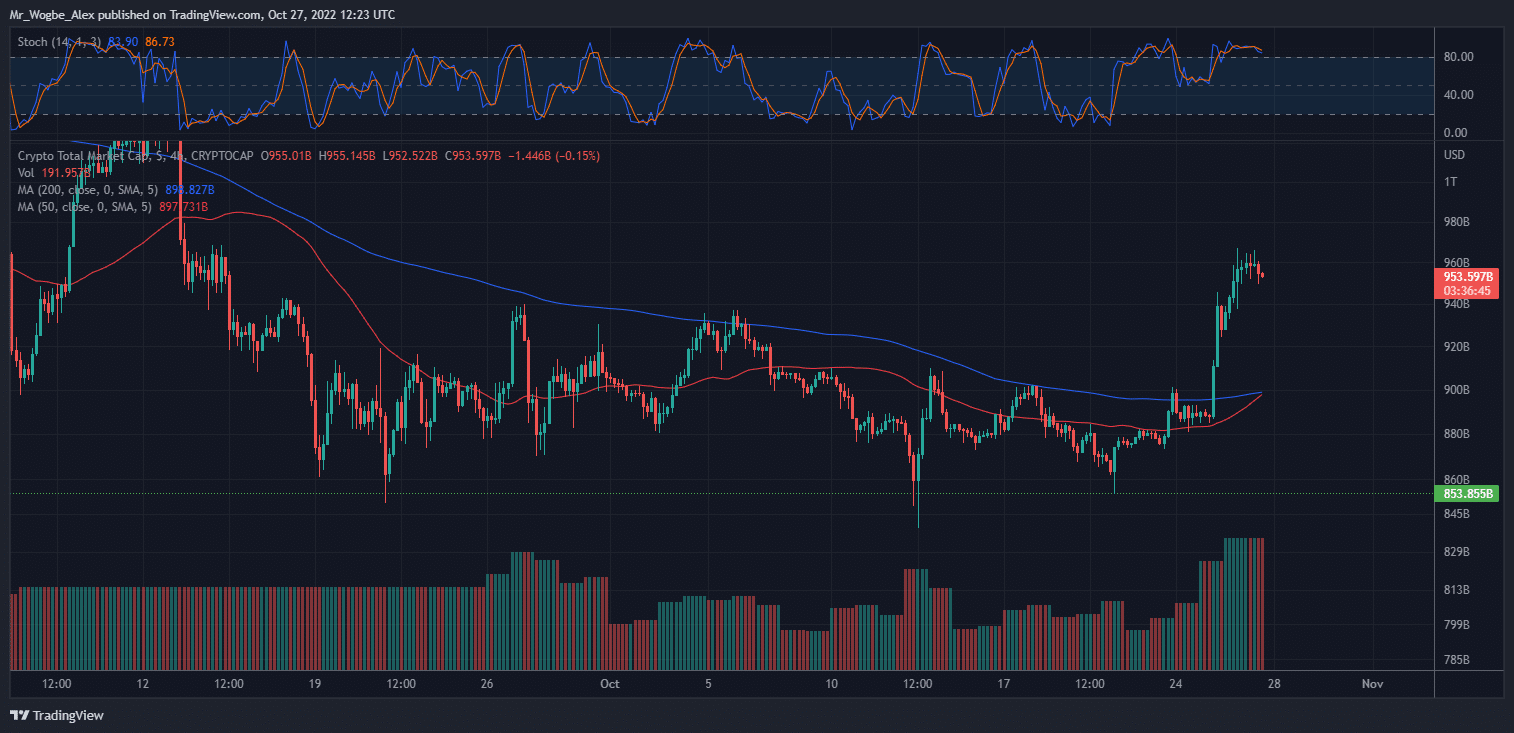

The crypto market had a significant crash, but some assets are now showing signs of recovery. In the most recent bullish movement, Ethereum (ETH) rocketed up by 14% while Bitcoin (BTC) increased by 5% to retake the $20K region.

In the most recent bullish movement, Ethereum rocketed up to 14% while Bitcoin (BTC) increased 5% to retake the $20K region.

In the midst of all of this, it was discovered that over $1.12 billion in liquidations, largely on short positions, had occurred. It should be remembered that 156,040 dealers were liquidated on the previous day. CoinGlass published this information.

With a massive $550.13 million and $476.06 million in liquidation, respectively, Bitcoin and Ethereum were the two biggest assets. The following two positions were taken by Cardano (ADA) and Ethereum Classic (ETC), which each received $17.10 million and $7.90 million.

A liquidation occurs when a leveraged position is closed out as a result of the trader losing some or all of their initial margin. This typically happens when a trader lacks the capital to maintain the open position because they are unable to meet the margin requirements for a leveraged position.

Crypto Exchanges FTX, OKEx, and Binance Recorded the Highest Liquidation

FTX, OKEx, and Binance were the exchanges that saw the most liquidations. Increased short liquidations were observed on all of these exchanges. FTX recorded liquidations at $842.75 million during the previous 24 hours, while OKEx was at $91.16 million.

The largest cryptocurrency exchange in the world by trading volume, Binance, had liquidations totaling $71.30 million. In contrast to the majority of the exchanges on the list, Bitfinex displayed a 92.51% long rate.

FTX recorded the Single largest liquidation

Notably, the most recent price movement caused a staggering $1.13 billion to be liquidated across the markets in the previous day, with more than $979 million, or 87% of that sum, being short positions or wagers against price increases.

Of the $1 billion in assets liquidated on October 26, about $550 million was in Bitcoin, followed by $476 million in Ethereum, with a $3.05 million ETH-USDT swap being the largest single order to be liquidated.

With $862 million, FTX had the largest liquidations out of all the exchanges, with nearly 77% of them being short positions.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.