A recent analysis from Kaiko Research highlights how crypto liquidity issues are leading to significant market manipulation and investor losses, with several high-profile cases emerging in early 2025.

The research specifically examines how scammers exploit low liquidity to orchestrate price pumps and dumps.

Understanding the Crypto Liquidity Manipulation Saga

The report points to the recent LIBRA token incident, backed briefly by Argentine President Javier Milei, as a prime example. The token crashed by over 80% shortly after its launch on major exchanges, with insiders pulling out approximately $107 million in USDC and SOL.

The scam worked because just a few wallets controlled 82% of LIBRA’s total supply, making it easy to manipulate prices.

Warning Signs of Liquidity-Based Scams

Market experts now identify several red flags that investors should watch for:

- Volume-to-liquidity ratio spikes: When trading volume suddenly becomes much higher than available market depth, it often signals potential price manipulation. For example, the TRUMP token showed an extremely high ratio of 290, with trading volume reaching $17 billion on January 20—about one-third of Bitcoin’s daily volume.

- Concentrated token ownership: When a small number of wallets hold most of a token’s supply, as seen with LIBRA, it creates perfect conditions for pump-and-dump schemes.

- Limited trading pairs: Some tokens, like LEO (Bitfinex’s token), show misleading market values because they trade on very few exchanges—only seven markets in LEO’s case.

The research emphasizes that market cap alone isn’t a reliable measure of a token’s real value. For instance, FTX’s native token (FTT) once reached a market cap of nearly $10 billion but never had enough liquidity to support that valuation, ultimately leading to massive investor losses.

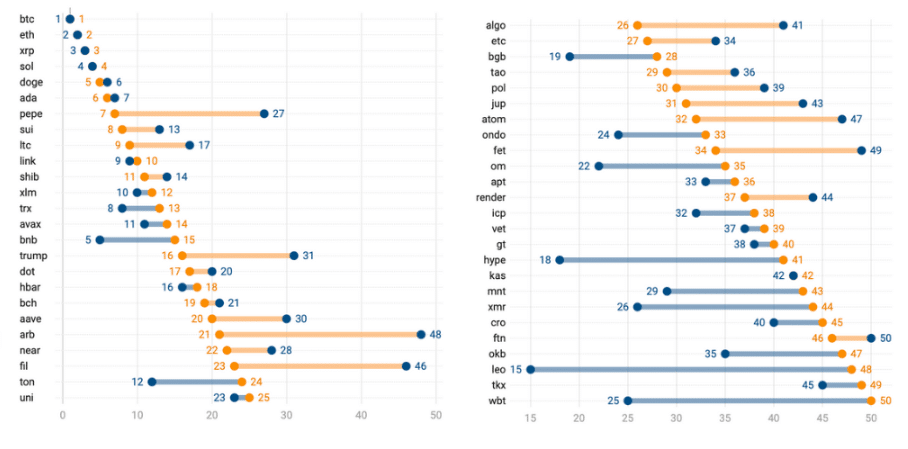

Looking ahead, the report suggests that while overall crypto market depth is returning to pre-FTX levels, more than half of the top 50 tokens still struggle to maintain daily trading volumes above $200 million. This persistent low liquidity creates ongoing opportunities for market manipulation.

For retail investors, the key takeaway is the importance of checking both market depth and trading volume before investing. A token’s high market cap or price alone doesn’t guarantee safety; the ability to easily buy and sell without causing major price swings (liquidity) is equally crucial.

The findings come as regulators worldwide increase their scrutiny of crypto markets, with particular attention to preventing manipulation and protecting retail investors from liquidity-based scams.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.