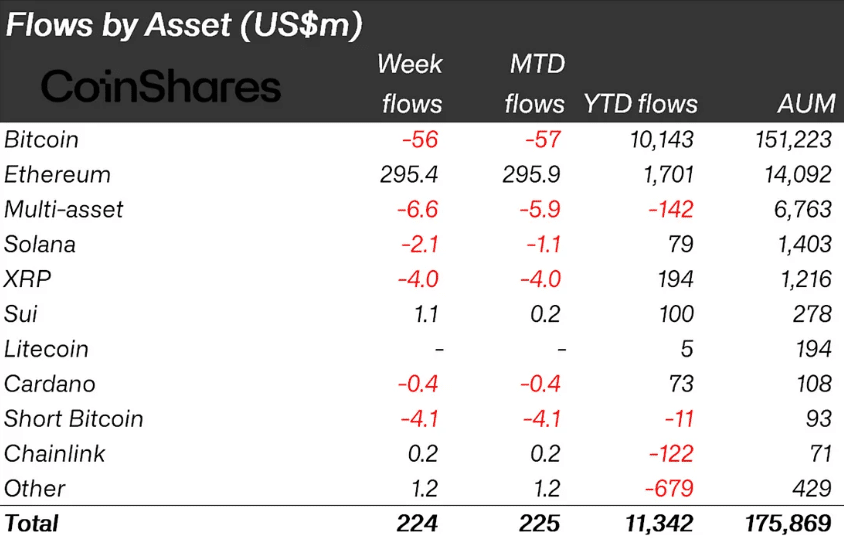

Digital asset investment products maintained their impressive streak last week, recording $224 million in crypto inflows despite growing uncertainty around Federal Reserve policy decisions.

According to CoinShares’ latest report, this marks the seventh consecutive week of positive flows, bringing the total to $11 billion during this period, though the pace has notably slowed as investors await clearer signals on monetary policy direction.

The United States dominated regional activity with $175 million in inflows, while Germany contributed $47.8 million and Switzerland added $15.7 million. Canada and Australia also posted positive numbers at $9.8 million and $6.5 million, respectively.

However, Brazil and Hong Kong experienced minor outflows, with Hong Kong’s $14.6 million exodus ending what had been record-breaking inflows for the region.

Ethereum Leads in Weekly Crypto Inflows Despite Bitcoin’s Struggles

Ethereum emerged as the week’s standout performer, attracting $296.4 million in fresh capital. This represents the asset’s strongest seven-week run since November’s election, with total inflows reaching $1.5 billion during this period.

Remarkably, Ethereum now accounts for 10.5% of total assets under management across all digital asset products, signaling a significant shift in investor sentiment toward the second-largest cryptocurrency.

Bitcoin faced headwinds for the second straight week, experiencing $56.5 million in outflows as policy uncertainty kept institutional investors cautious. Even short-bitcoin products saw redemptions, indicating broad hesitation around bitcoin exposure until regulatory clarity emerges.

Bitcoin ETFs Approach $1 Trillion Trading Volume Landmark

Meanwhile, US spot Bitcoin exchange-traded funds are closing in on an extraordinary milestone, approaching $1 trillion in cumulative trading volume less than 18 months after their January 2024 launch.

According to The Block, current volume sits at $995.2 billion as of June 9, with daily trading ranging between $2.3 billion and $4.4 billion over recent sessions.

BlackRock’s IBIT fund has established clear market dominance, capturing 79% of total trading volume and accumulating $70 billion in assets under management.

The fund achieved this $70 billion milestone in just 341 trading days, setting a new speed record that’s five times faster than the previous holder, the SPDR Gold Shares ETF.

The combined Bitcoin ETF complex now manages over $120 billion in assets, with cumulative net inflows reaching $44.9 billion since launch.

These figures demonstrate sustained institutional appetite for bitcoin exposure through regulated investment vehicles, even as direct cryptocurrency markets experience periodic volatility and regulatory concerns persist across global jurisdictions.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.