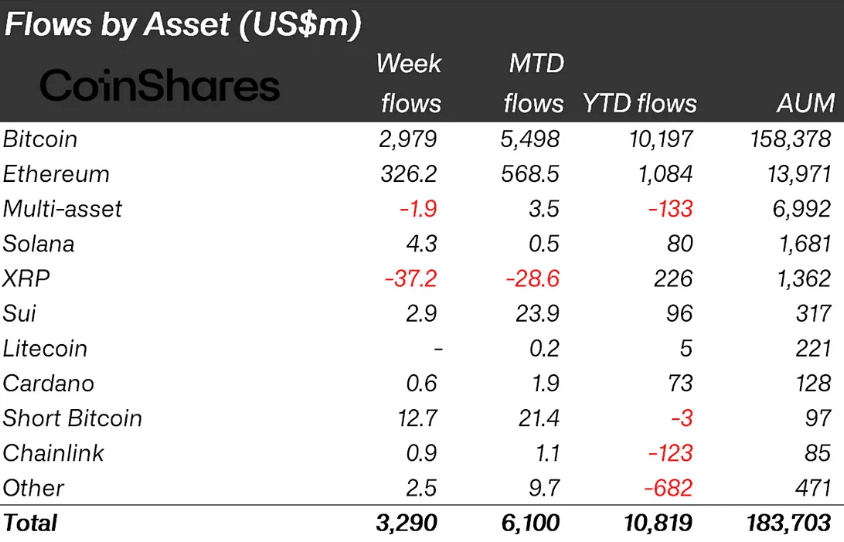

Crypto inflows have reached unprecedented levels, with digital asset investment products attracting $3.3 billion in a single week, pushing year-to-date totals to a record-breaking $10.8 billion.

This massive capital movement signals a fundamental shift in how institutional investors view cryptocurrency as a legitimate asset class.

According to CoinShares, the current inflow streak extends six consecutive weeks, accumulating $10.5 billion during this period alone.

Total assets under management briefly peaked at an all-time high of $187.5 billion, demonstrating the growing appetite for digital asset exposure among professional investors.

Bitcoin dominated the weekly inflows, capturing $2.9 billion of the total figure.

This represents approximately 25% of all Bitcoin-related inflows recorded throughout 2024, highlighting the cryptocurrency’s continued status as the preferred digital asset for institutional allocation strategies.

Geographic Distribution of Crypto Inflows Shows US Leadership

The United States led global crypto inflows with $3.2 billion entering American investment products. Germany followed with $41.5 million in inflows, while Australia and Hong Kong contributed $10.9 million and $33.3 million, respectively.

Swiss investors took a contrarian approach, withdrawing $16.6 million as they capitalized on recent price appreciation to secure profits.

Ethereum experienced its strongest performance in 15 weeks, attracting $326 million in fresh capital. This marks the fifth consecutive week of positive flows for the second-largest cryptocurrency, suggesting renewed confidence in its long-term prospects among institutional allocators.

Short Positions and Alternative Assets Gain Traction

Interestingly, some investors viewed recent price gains as shorting opportunities, with short-Bitcoin products receiving $12.7 million in inflows—the highest weekly figure since December 2024.

This indicates sophisticated investors are employing hedging strategies within their digital asset portfolios.

XRP faced significant headwinds, ending its remarkable 80-week inflow streak with $37.2 million in outflows, representing the largest single-week withdrawal on record for the asset.

Institutional Adoption Accelerates Beyond Trading

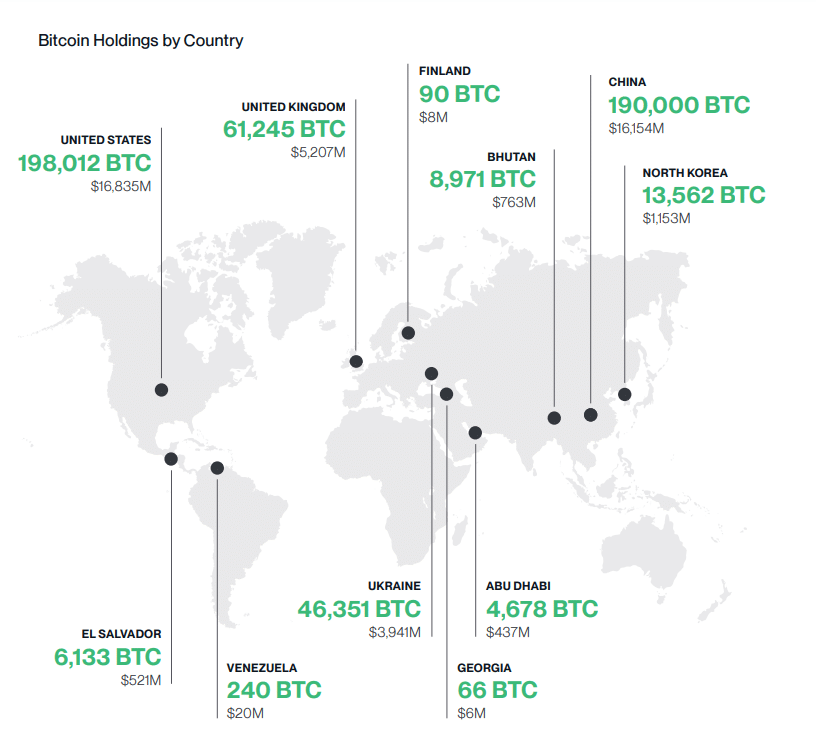

Beyond traditional investment flows, institutional adoption continues expanding through direct corporate treasury allocations.

Bitwise Investments’ projections suggest institutional capital could reach $426.9 billion by 2026, potentially controlling 20% of Bitcoin’s total supply through corporate treasuries, sovereign wealth funds, and exchange-traded products.

This supply dynamic creates structural pressure on available Bitcoin, particularly following the 2024 halving event that reduced new issuance to approximately 164,250 BTC annually.

The combination of reduced supply and increased institutional demand establishes conditions for sustained price appreciation, though market participants must navigate regulatory uncertainties and potential coordinated selling pressure from large holders.

Current market conditions reflect growing institutional recognition of digital assets as portfolio diversification tools, driven partly by concerns over traditional economic indicators and monetary policy uncertainties.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.