The crypto market has seen remarkable activity this month, with digital asset investment products recording $882 million in crypto inflows last week, marking the fourth consecutive week of gains.

This pushes year-to-date (YTD) inflows to $6.7 billion, approaching the peak of $7.3 billion reached earlier in February 2025, according to the latest CoinShares report.

What’s Driving the Latest Crypto Inflows?

Several key factors are powering these strong investment flows. Some of them are:

- A global rise in M2 money supply

- Stagflationary risks in the United States

- Several US states approving Bitcoin as a strategic reserve asset

Bitcoin dominated the investment scene, attracting $867 million globally last week. US-listed ETFs have now reached a record $62.9 billion in cumulative net inflows since their January 2024 launch, surpassing the previous high of $61.6 billion set in February.

While Bitcoin remains the primary driver, altcoin performance has been mixed. Despite Ethereum’s sharp price increase, it saw relatively modest inflows of just $1.5 million.

However, Sui has emerged as a standout performer with $11.7 million in inflows, overtaking Solana (which experienced $3.4 million in outflows). On a year-to-date basis, Sui has now attracted $84 million in investments compared to Solana’s $76 million.

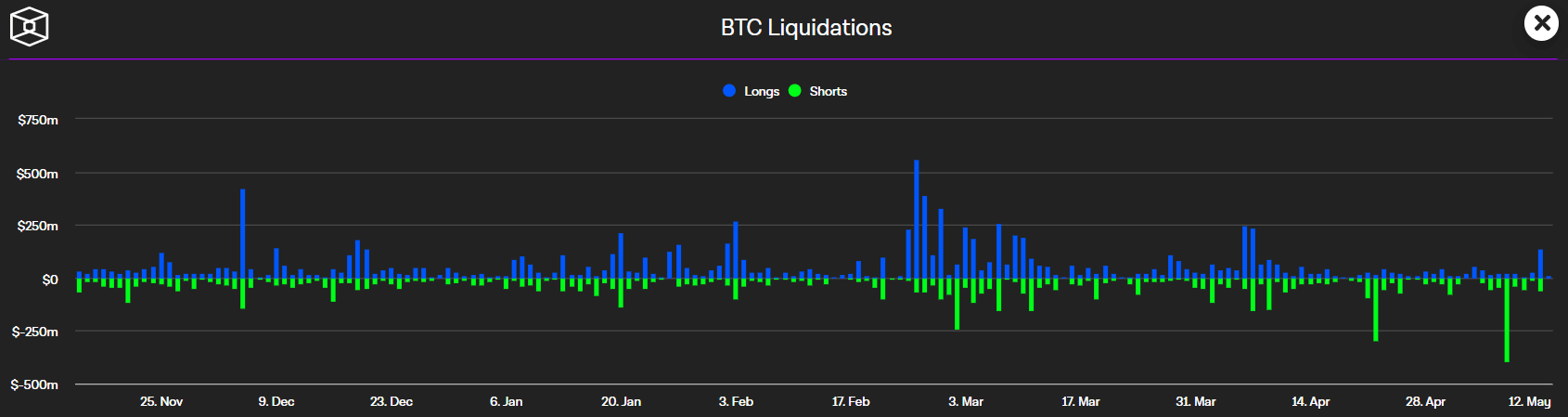

Historic Short Liquidations Rock the Market

In parallel with these strong inflows, the crypto market experienced its largest single-day short liquidation event of 2025 on Thursday, May 8. More than $670 million in positions were wiped out, with Bybit accounting for the largest share at $290.8 million (43.4% of the total), followed by Binance with 26.5%.

The liquidation pattern continued through the weekend, with Friday recording $301 million and Saturday seeing $233 million in additional short liquidations. While Bitcoin short liquidations made up $394 million of Thursday’s total, they dropped sharply afterward.

Altcoins, by contrast, dominated the weekend action, accounting for 86% of Friday’s and 75% of Saturday’s liquidations.

This surge in liquidations was triggered by significant price increases across the board. Bitcoin rose by approximately 6.4% on Thursday, while Ethereum jumped by around 22%. The altcoin market, represented by TOTAL3, climbed more than 7%.

With US-China trade war resolution talks underway and continued institutional investment, these market movements signal growing mainstream acceptance of digital assets as both investment vehicles and strategic reserves.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.