Crypto inflows rebounded dramatically last week, reaching $572 million after a turbulent start that saw $1 billion in outflows.

The recovery came following the U.S. government’s landmark decision to permit digital assets in 401(k) retirement plans, triggering $1.57 billion in fresh investments during the week’s second half.

BREAKING: 🇺🇸 President Trump signs executive order to allow Bitcoin and crypto in 401(k)s. pic.twitter.com/NVXuhfzw3K

— Bitcoin Magazine (@BitcoinMagazine) August 7, 2025

The approval represents a significant shift in institutional adoption, providing millions of American workers access to cryptocurrency investments through their employer-sponsored retirement accounts.

This regulatory milestone helped offset earlier concerns stemming from weak U.S. payroll data that initially spooked investors.

Ethereum Dominates Weekly Investment Activity

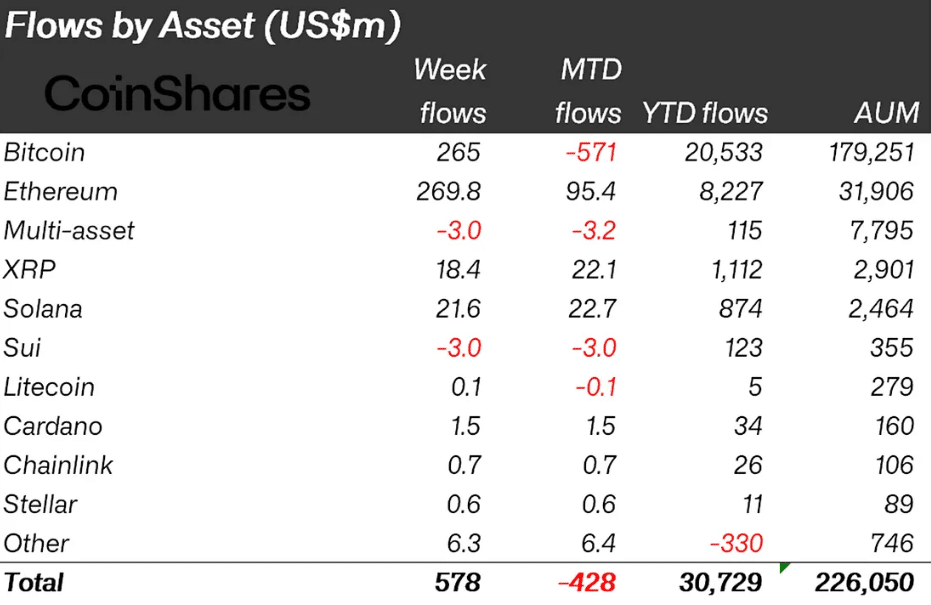

Ethereum exchange-traded products led the charge with $268 million in weekly inflows, pushing year-to-date investments to a record-breaking $8.2 billion.

The second-largest cryptocurrency’s assets under management reached an all-time high of $32.6 billion, representing an 82% increase since January.

The surge reflects growing institutional confidence in Ethereum’s proof-of-stake network and its expanding ecosystem of decentralized applications.

Recent corporate treasury adoption has further amplified demand, with companies accumulating over $9 billion worth of ETH in recent months.

Bitcoin recovered momentum after two consecutive weeks of outflows, attracting $260 million in fresh investments.

The flagship cryptocurrency’s rebound coincided with renewed institutional interest and improved market sentiment following the retirement plan announcement.

Alternative cryptocurrencies also benefited from the positive momentum. Solana captured $21.8 million in inflows, while XRP and Near Protocol secured $18.4 million and $10.1 million, respectively. This demonstrated broadening investor appetite beyond major cryptocurrencies.

Regional Crypto Inflows Pattern Shows U.S. Leadership

Geographic distribution revealed a strong North American preference for digital assets. The United States recorded $608 million in inflows, while Canada added $16.5 million.

European markets remained cautious, with Germany, Sweden, and Switzerland collectively experiencing $54.3 million in outflows.

Trading volumes decreased 23% compared to the previous month, likely reflecting typical summer market patterns.

However, the 401(k) approval and sustained institutional demand suggest the current rally could extend beyond seasonal trends, particularly as more retirement funds gain cryptocurrency exposure.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.